UK feed wheat futures contracts for May-23 and November-23 delivery dropped by £31 and £20 per tonne respectively between 1st March and 23rd March. Declines have been driven by the renewal of the Black Sea grain corridor and good prospects for EU crops.

The Black Sea grain deal allowing shipments of grain from Ukrainian ports (mainly Odessa) has now been renewed, but only for 60 days. Previous extensions have been for 120 days; the shorter agreement length means commodity traders will have to contend with a greater degree of geopolitical uncertainty. That said, the continued transit of grain through the Black Sea is bearish for grain pricing.

Old crop (May-23) futures rallied by almost £10 per tonne on Friday 24th March, on suggestions that Russia would not grant export licenses for shipments below a certain price. Theoretically this sets a floor to old crop grain prices.

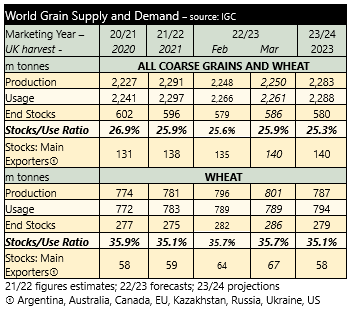

The International Grain Council (IGC) published and updated forecast for 2022/23, and its first estimates of global grain supply and demand for the 2023/24 season. In 2022/23 (harvest 2022 in the UK) the supply and demand situation is seen softening, with growth in ending stocks driven by reduced consumption. However, for 2023/24 the grain market is projected to be tighter year-on-year – again driven by consumption. The level of global grain ending stocks is forecast to fall by 5.4 million tonne year-on-year.

With concerns already for the lack of rainfall in parts of the USA and the EU any adverse weather for the 2023/24 crop would support prices. The first wheat condition reports in the USA are due in early April, alongside the first update on maize plantings. Early yield estimates for the EU suggest a 3% increase for wheat, versus the five year average.