Tag: Grain

Crop Areas 2025

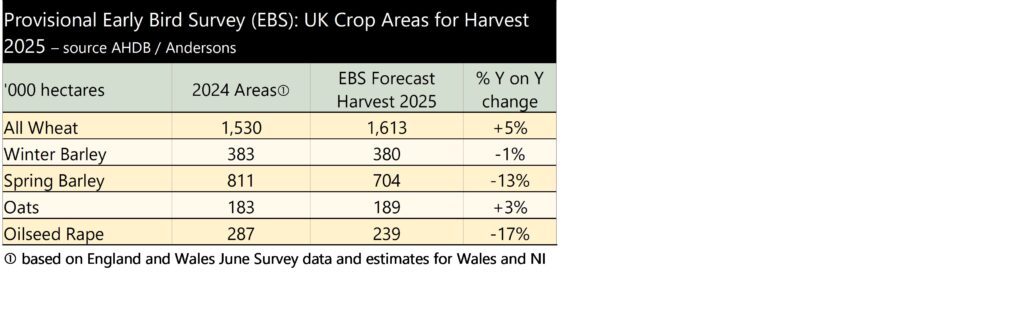

The wheat area is forecast to increase by at least 5% for harvest 2025. This follows last year’s rain-affected reduced acreage. Figures from AHDB’s Early Bird Survey show a potential acreage of 1.61 million hectares of wheat. The survey is based on a snapshot in time, and dry weather after returns may have led to further increases in area, up to 1.7 million hectares.

The big ‘loser’ in cropping this year is oilseed rape. Increased growing risk and poor returns has resulted in growers turn their back on the crop. United Oilseeds forecast the area planted in the UK this winter at 215,000 hectares, a 40-year low. The reducing crop area has prompted an industry group led by United Oilseeds to launch an ‘OSR reboot’. The relaunch is aimed at increasing confidence in the crop. This, in turn, aims to increase the ability of UK farmers to satisfy domestic crush demand (around 2 million tonnes).

Revised Early Bird Survey figures will be available in December. These will incorporate the final UK June Census figures and further survey returns for later plantings this autumn.

Global Grains

Grain markets have been increasingly volatile in July, driven once again by the Black Sea. US maize crop conditions have improved, but weather concerns still linger.

Ukraine/ Russia

The renewal, or lack thereof, of the Black Sea Grain Initiative (BSGI) has been a key watchpoint for grain markets for the past year. The agreement, guaranteeing the transit of agricultural commodities, broke down on 17th July 2023. The ending of the BSGI, came with missile strikes at the port of Odessa, and threats of military action against vessels delivering cargos to Ukraine.

In response to the ending of the BSGI, and subsequent concerns about global grain availability, UK feed wheat futures have been more volatile. Between 17th July and 19th July UK feed wheat futures (November 2023), gained more than £16 per tonne, before falling back by £5 per tonne.

The lack of the BSGI and exports through a key port such as Odessa is undoubtedly a challenge to global grain availability. However, reports from key commentators highlight the important role of the Danube and exports via Constanta, Romania, have played, and will continue to play, in keeping grain moving. An increase in Ukrainian grain being exported by road, rail and waterways through Eastern Europe could cause downwards pressure on grain prices in the countries bordering Ukraine. Some Governments have already placed restrictions on trade – for example grain can only transit through their territories.

The movement of Black Sea grain will continue to be a focal point. Further attacks on the Danube port of Reni lifted prices on Monday 24th July.

United States

Following last month’s update, the US Corn Belt has received much-needed rain. Drought as the crop moved towards silking negatively impacted crop conditions and was a risk to yield prospects.

Yield forecasts have been lowered but remain at record levels due to high planted areas. While weather remains a risk to the crop, the global supply and demand balance is little changed. In July, the USDA increased the area of maize it expects to be harvested by 900 thousand hectares.

The increase in the area of maize comes at the expense of soyabeans, with the area expected to be harvested falling by 1.6 million hectares. The cut to the soyabean area has added significant support to the wider vegetable oil complex, including rapeseed.

Hotter weather and less rain is forecast in the Corn Belt through the first week of August so conditions remain uncertain.

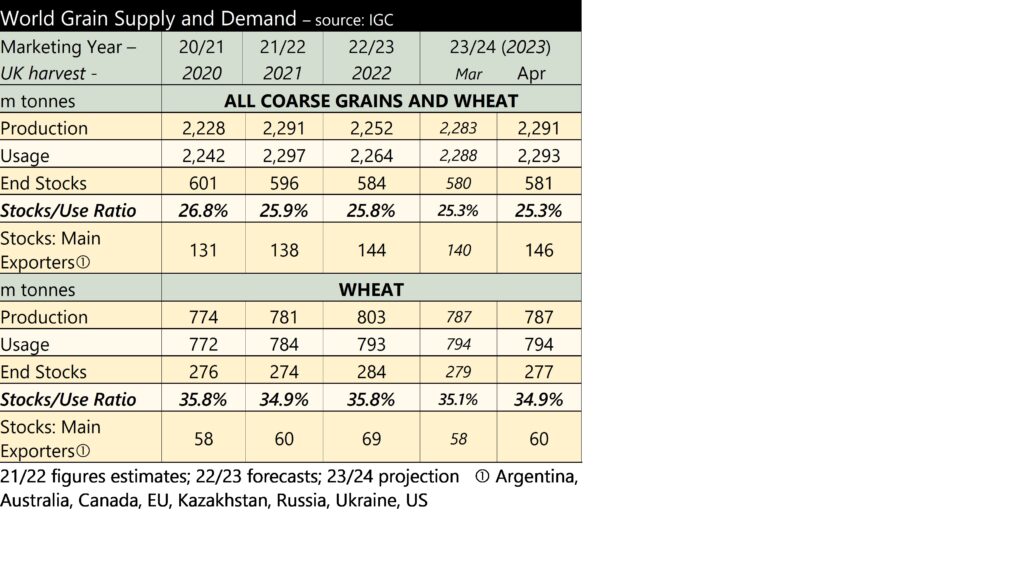

Global Supply and Demand

The latest global supply and demand figures highlight the continued view from the USDA that the world will be better supplied with grain this coming season. But there is a diverging picture between maize and wheat. Global maize stocks are forecast to grow by 17.8 million tonnes year-on-year. Meanwhile, wheat ending stocks are forecast to fall by 2.8 million tonnes; to the lowest level since 2015/16. Wheat production was estimated to decline further in July’s USDA World Agricultural Supply and Demand Estimates, driven by month-on-month declines in Argentina, Canada, and the EU.

Grain Market Update

In February’s Bulletin we highlighted that the fast pace of imports of Ukrainian crops into the EU was pressuring prices. This came to a head in April with Poland, Hungary, Bulgaria, Romania, and Slovakia announcing bans on the import of Ukrainian agricultural goods. The EU has proposed measures to guarantee that crops moving into those nations are re-exported and do not remain in those five domestic markets. In addition, the EU has proposed the provision of €100m to compensate farmers in those nations. At present there is no agreement on whether this deal will be accepted. The news of the bans initially supported prices, but they have subsequently fallen.

Further uncertainty for grain markets has been caused by the 60-day terms the Black Sea grain corridor now operates under. Comments suggesting the G7 would ban exports to Russia, were reacted to by former Russian president Dmitry Medvedev with suggestions of the Corridor agreement being scrapped in retaliation. This has served to support grain prices in the short-term. Overall, the situation in the Black Sea remains a dominant driver for grain and oilseed markets.

Looking ahead to the global supply and demand picture for next season (2023/24), the global grain stocks picture was eased slightly in the latest International Grains Council supply and demand figures, owing to greater maize production, particularly in the US. That said the overall picture remains tighter year-on-year. With weather concerns in part of the US, particularly for wheat, any adverse weather would support prices.

UK grain prices moved higher following the uncertainty around Black Sea grain movement. UK feed wheat (ex-farm, nearby) was quoted at £190 per tonne in the week ending 21st April. This is up around £8 per tonne on the month. The milling premium also extended slightly, quoted at £61 per tonne. Feed barley has struggled to find demand in 2023 but has been able to compete into export markets recently. The feed barley price was quoted at £170 per tonne, on 21st April.

Oilseed rape prices have fallen since the start of the year. However, concerns around dry weather in Argentina has continued to cut soyabean production forecasts supporting the wider oilseed complex. Oilseed rape prices have risen by nearly £30 per tonne, month-on-month, to £380 per tonne. That said, expectations remain for bigger global rapeseed crops in 2023/24. Also, a bumper Brazilian soyabean harvest is expected which adds pressure vegetable oil markets. Oilseed rape prices may be supported in the longer term with the EU Parliament backing a ban on imports linked to deforestation, including palm oil and soya. Companies selling into the EU will now have to provide verifiable information that goods were not grown on land which has been deforested after 2020.

Pulse prices have been stable month-on-month, with pea and bean prices unchanged at £226 and £220 per tonne, respectively.

The last month has been a busy one for the majority of arable farmers, the wet conditions of March have led to a backlog of planting and spraying. While April conditions have not been ideal they have at least allowed field work to continue.

Grain & Oilseed Market

This month, the first UK wheat and barley supply and demand figures for harvest 2022 were published by AHDB. A 15.7 million tonne crop has left the UK looking well supplied.

Given the increase in available supplies relative to last season, the discount of UK feed wheat futures to Paris milling wheat futures has grown. This will prompt increased export demand for UK grains.

The Pound closed on Friday 21st October at £1=$1.13, almost 7% lower against the Dollar than on 1st July. It is worth highlighting that this is up significantly from the low of £1=$1.07 at the end of September. The political and economic uncertainty in the UK that has caused the Pound to weaken at least increases the attractiveness of UK exports.

Wheat values have bounced around over the course of the past month, mostly driven by uncertainty over the Ukraine-Russia grain shipment deal. However, with things returning to the status quo in the Black Sea, at least for the time being, grain values have fallen back. On Friday 21st October, ex-farm feed wheat was worth £256 per tonne, down £12 per tonne from 23rd September. Milling wheat prices have fallen £11 per tonne over the same time period to £311 per tonne.

AHDB’s barley supply and demand estimates shows UK production at 7.2 million tonnes. The commentary alongside the estimates highlights a decline in barley demand in animal feed driven by a switch to wheat. Barley is currently at a £19 per tonne discount to feed wheat. If demand falls further, without a strong gain in exports the discount will grow. Given the reductions in the size of the pig herd, a fall in barley demand seems likely.

In the next three months, the size of the South American maize crop will be a key driver of price. Brazil and Argentina are key suppliers globally and are set to experience a third successive la Niña. The weather pattern brings drier than normal weather and tends to reduce output.

UK ex-farm oilseed rape is worth £521 per tonne, up almost £30 per tonne on the month. Vegetable oils are the key driver of support for oilseed rape. The destruction of a key sunflower oil processing plant in Ukraine, uncertainty over palm oil output in Southeast Asia, and strong EU purchasing (both rapeseed and sunflower seed) combined to support prices. A large soyabean crop, globally, and expectations of big canola (OSR) crops in Australia and Canada is tempering prices.

Feed bean values continue to move lower on lacklustre demand both domestically and for export.

Crop Areas 2022

Defra has published the first official crop area figures for harvest 2022. These only relate to England at the moment; full UK figures are due next month. Given the raft of data previously published on crop areas, there are no real surprises in the release.

In 2022, the English wheat area was 1.67 million hectares, an increase of 13,000 hectares on 2021. Wheat area increased in all regions of England, except the Eastern region where area fell by just 0.3%. The rapeseed area increased by the largest amount year-on-year. Oilseed rape prices were considerably higher than in recent years during July to September last season. As a result, the OSR area increased by more than 54,000 hectares, up 20% on 2021. There were large increase in the East Midlands (+11.4Kha), West Midlands (+8.7Kha), Yorkshire and the Humber (+8.5Kha), and the Eastern region (+8.5Kha). Further increases in OSR area were anticipated for harvest 2023. However, given the incredibly dry summer and lack of rain in late August/ early September for many regions, planting issues will limit the increase.

The rise in rapeseed area for 2022 was, seemingly, at the expense of barley and oats. The overall area of the barley crop in England was the lowest since 2015, at 782,000 hectares. Spring barley area fell by the largest amount, down more than 60,000 hectares. The planted area of oats fell by 19,000 hectares, to 140,000 hectares. The area of rye in England has increased considerably in the last ten years. In 2013, it was just 6,000; in 2022 this had increased to just below 40,000. The crop has potential in multiple markets, including pig feed, which is likely a driver of the increase.

The first official Defra harvest estimates for cereals and oilseed production in are typically published in October, followed by the final UK results in December. Looking to the 2023 harvest, the results of the ‘AHDB Early Bird’ survey (conducted by Andersons) will provide the first robust indication of areas. Regional results will be available in December 2022.

Ukrainian Grain Shipments

On 22nd July, Russia and Ukraine reached an agreement to allow shipments of grain to leave Black Sea ports. Reports suggest that up to 20 million tonnes of old-crop grain, needs to be exported from Ukraine. Understandably, the news of the grain deal caused markets to fall significantly, owing to expectations of increased grain availability. UK feed wheat futures (November 2022) dropped by £16.75 per tonne on the day.

Prices have since recovered, despite the first vessels having left Ukraine. One vessel has successfully passed inspection in Turkey, en-route to Lebanon. The continued movement of vessels out of Ukraine ought to lead to a fall in prices. However, there are some key considerations which may limit any drop. These include;

- Volume of grain – the primary factor, which could prevent a sustained fall in prices is the volume of grain which needs to be moved. The grain deal only runs for 120 days, yet if reports are to be believed there is circa 20 million tonnes of old crop grain alone needing to be moved. That is around 170,000 tonnes of grain per day. There are a number of vessels waiting to leave Odessa, a key grain port, which will move with comparative ease, but this will not be the case for all of the grain.

- Logistics – logistical challenges are likely to restrict the volume of grain that can be shipped. Contrary to some reports, the volume of grain needing to be exported is not held at ports, or in a single province. It needs to be moved from within Ukraine to ports before it can be shipped.

- Insurance and crew – one of the primary concerns surrounding the ability to ship grain was the insurance premium on vessels although, given grain is now moving, this would not appear to be to prohibitive. Crewing the vessels may be another challenge, each vessel needs 20+ crew.

- Russia – the big caveat to all shipments at the moment is Russia’s intentions. The day after the deal was signed, it shelled the port of Odessa. This was followed a few days later by the killing of a prominent Ukrainian grain exporter in Mykolaiv. Similar incidents over the next 120 days will have as much impact on grain prices as the movement of vessels out of the Black Sea.

Shipments of grain out of Ukraine will ease prices, however, there still remains a lot of grain to be moved. The risk of Russia reneging on the shipment deal will also remain a concern. This will fundamentally limit the fall in prices. Furthermore, it is worth highlighting that there is still underlying support for grain prices with supply and demand of global grain tighter year-on-year. There is also continued uncertainty over the condition of the EU maize crop, due to heat stress, keeping prices supported.

UK Grain Market Update

The UK grain and oilseed harvest is well ahead of typical pace. Much the UK barley crop and swathes of the Oilseed Rape crop have been cut. Many farmers are now well into their wheat crops some 7 to 10 days ahead of normal. Early indications point to high bushel weights among winter grain crops.

UK grain markets have tracked global prices in recent weeks. Both new and old crop wheat prices have fallen in response to the availability of grain in Europe and the US. UK feed wheat prices (ex-farm) were quoted at just over £242 per tonne on 22nd July. Milling premiums have also fallen back to around £25 per tonne, ex-farm. However, if high specific weights persist throughout harvest, diluting the proportion of protein, we are likely to see an increased premium for good protein levels.

Feed barley prices have been pressured downwards by harvest progress, quoted at a £31 per tonne discount to wheat, at £211 per tonne.

Oilseed rape prices have also fallen considerably over the course of the last month. Oilseed rape (spot) is now worth £534 per tonne, down from £596 per tonne at the end of June. This is in part due to the move from old crop to new crop pricing. Similar declines have been seen in November 2022 Paris Rapeseed futures. This points to an overall easing in response to improved supply and weaker demand of oilseeds globally. An increase in oilseed rape plantings is anticipated for harvest 2023. However, a lack of soil moisture may cap these gains.

Feed beans and peas were quoted at £282 and £272 per tonne, respectively (spot, ex-farm). Prices are back to tracking wheat prices closely after wheat had opened up a large premium earlier in 2023.

Harvest pressure is inevitable at this time of year. A greater surplus of UK grain, either for export or closing stocks, is expected in the coming season. This will drive a closer relationship between UK and EU grain prices. While there is short term pressure in prices, long-term the global supply and demand of grains remains tight.

Global Grain Markets Update

Global grain market prices have fallen over the last month. Global grain harvests are progressing, and Russia and Ukraine have reached an agreement, mediated by Turkey, on the movement of grain. Both of these factors have eased concerns about tight supplies in the coming season. Despite the easing of supply concerns, and prices, in the short term, some underlying concerns remain.

The big news towards the end of July, was the agreement between Russia and Ukraine of new export channels. Again, this has eased some short-term concerns. Grain prices moved sharply lower on Friday 22nd July as a result. However, agreeing that grain can be exported from Ukraine is very different to the reality of actually exporting it. On Saturday 23rd July shelling resumed at the port of Odesa, the key grain terminal covered by the agreement. Even if a solution is found and ports are de-mined, insurance premiums on vessels will surely be much higher than previously, which would impact competitiveness of the region.

In Europe and North America, grain harvests are progressing well, benefitted by dry weather. The winter wheat harvest in the US is 70% complete, in line with average progress. Additionally, the condition of the spring wheat crop is vastly better than last season. The US has exported large volumes so far, supporting the view of larger crops.

In France, the wheat harvest is 84% complete, as of 18th July. This time last season it was only 12% complete. Again, progress has been good following hot dry conditions. As with the US harvest this fast pace to harvest has eased short-term global supply concerns.

Whilst hot weather in the EU has allowed harvests to progress, it is concerning for the development of the maize crop. The amount of the maize crop rated “good” or “excellent” fell by eight percentage point in the week to 18th July, to 75%, while this is still positive if high temperatures continue, conditions could fall further offering some support.

The United States Department of Agriculture released its global supply and demand estimates earlier in July. These estimates highlight concerns about overall availability of grain this season. The stocks-to-use ratio of wheat, barley, and maize is the lowest since 2013/14. While not dramatically tighter than last season, it is worth bearing in mind that China holds 58% of the world’s grain stocks, at least on paper. If we exclude China from the stocks-to-use calculation, availability for the coming season is the lowest since 1996/97.