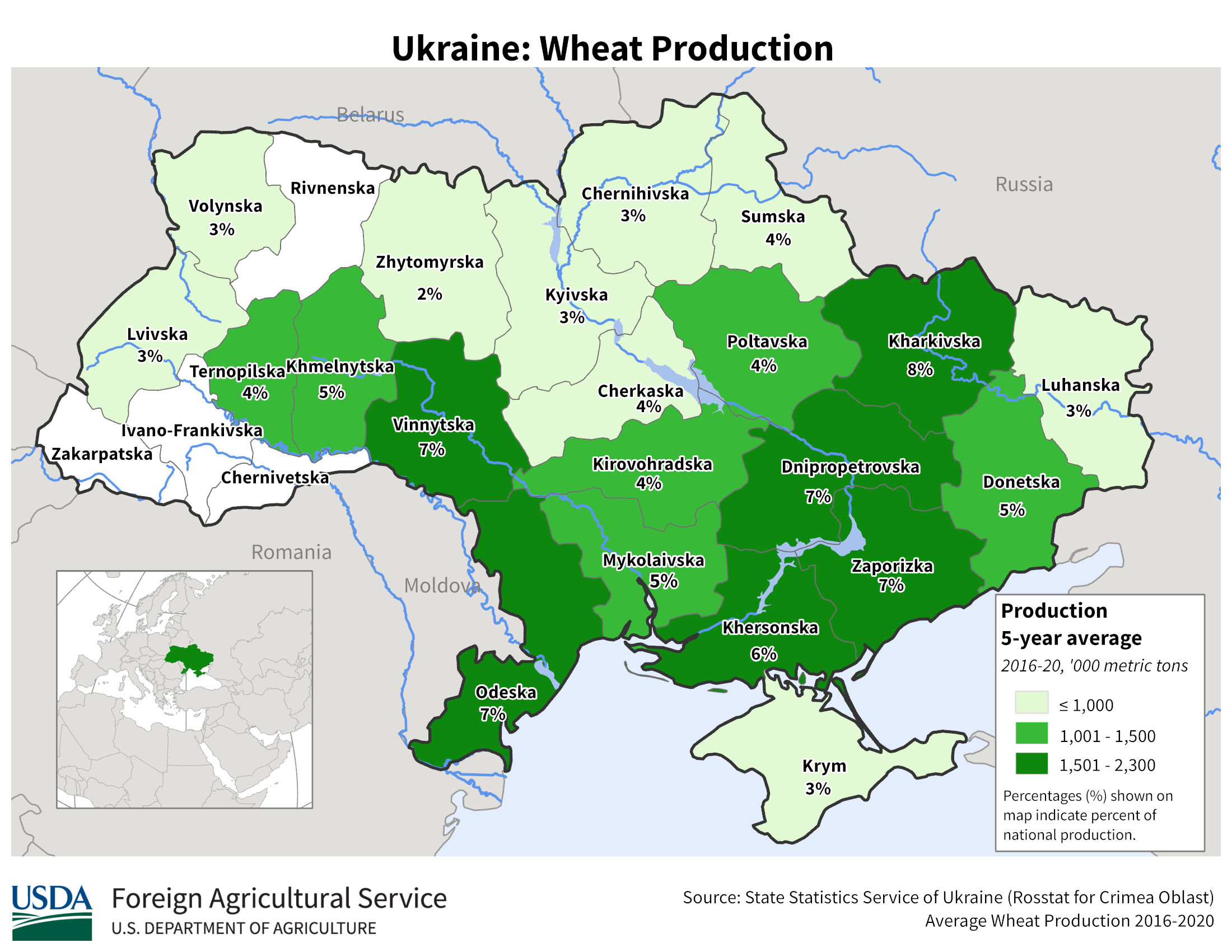

As the conflict in Ukraine continues, the value of commodities has risen considerably. On Monday 7th March UK feed wheat futures (May-22) closed at £303 per tonne, a rise of almost £68 from 23rd February, the day before the invasion began. While prices have risen, daily movements have been volatile. Russia and Ukraine account for more than 28% of world wheat exports, as such developments in the conflict will have large ramifications for prices.

Despite the large rises in output prices as a result of the conflict, input prices are equally inflated. Russia is a key producer of fertiliser and exporter of fuels. The price of fuel is likely to stay inflated, with the UK and US governments announcing, on 8th March, their intention to ban Russian oil imports. The UK ban will be phased, Russian supplies of fossil fuels account for 8% of UK imports.

Outside of global politics, the International Grains Council (IGC) lowered its estimate of global grain stocks for the 2021/22 (current) season. This was due to cuts in Southern Hemisphere maize production forecasts where dry weather is impacting on crop expectations. This is also likely to be a continued driver of grain price rises.

Despite the factors globally which point to further grain price rises, we also need to consider the new crop (2022/23) when looking at the direction of grain prices. The IGC has tentatively forecast an increase in grain stocks; as we move nearer to the new crop market the expected availability of the 2022/23 crop will have an increasing influence over prices. On 9th March the USDA is set to update its world supply and demand estimates, these will be watched closely.

In the UK, milling wheat premiums remain high relative to recent seasons. Milling wheat premiums will be watched closely as we move towards spring in light of the high cost of nitrogen. Feed barley prices have followed the same path as wheat prices, tracking lower through February before recovering.

Ex-farm oilseed rape prices have fallen back from their December high of £627 per tonne. Rapeseed prices have responded to the incredibly tight UK, European and Global oilseed rape supply and demand. However, prospects for the new crop are for improved supplies. This will lead to lower prices than we have seen this year. Of course, there is some time before the rapeseed harvest and the fundamentals still have time to change. Soyabeans also need watching for the direction of rapeseed. The dry weather in South America has supported soyabean prices and tightened the supply and demand outlook. The United Nations Food and Agriculture Organisation cut its estimates of South American soyabean production by 13.5 million tonnes (3.7%), earlier in March. A tightening of global vegetable oil and oilseed markets will lead to price rises.

Pulse prices remain flat through January and February, moving by just £1 per tonne across the last month.