Category: Uncategorised

EU-Mercosur Trade Deal Negotiation

After more than two decades of negotiations and false starts, the EU and Mercosur (a South American trade-bloc consisting of Brazil, Argentina, Uruguay and Paraguay) concluded negotiations on a Free Trade Agreement (FTA) on 6th December. Whilst it is the biggest FTA negotiation that the EU has ever concluded, and despite the environmental safeguards now built-in which hindered the deal in recent years, there are still several hurdles to overcome before the deal would enter into force. That said, the conclusion of negotiations is notable and the FTA would have a significant impact on EU agriculture if enacted. It would also have indirect implications for the UK.

The key provisions of the agreement are:

- Market access: significant tariff reductions for agricultural exports from Mercosur to the EU, with quotas introduced on more sensitive products (see next points). There will also be export opportunities for EU agricultural sectors like wine, spirits, and dairy products into Mercosur markets.

- Tariff Rate Quotas (TRQs) for Mercosur exporters to the EU:

- Beef: 99 Kt of carcass weight equivalent (CWE), of additional quota for Mercosur exports to the EU, subdivided into 55%fresh and 45% frozen with an in-quota tariff rate of 7.5%. There will also be an elimination of the existing in-quota rate in the Mercosur-specific WTO “Hilton” quotas, once the new FTA enters into force (combined this equates to around 46.8 Kt, which signifies a net increase of about 52.2 Kt, once the full TRQ has been phased in). The volume under the new FTA will be phased in in six equal annual stages.

- Poultry: 180 Kt CWE duty free, subdivided into 50% bone-in and 50% boneless. This will also be phased in via six equal annual stages. The 2024 updated negotiations also feature an additional 1.5 Kt of TRQ to Paraguay.

- Pigmeat: 25 Kt with an in-quota duty of €83 per tonne. The volume will be phased in in six equal annual stages.

- Sugar: elimination at entry into force of the in-quota rate on 180 Kt of the Brazil-specific WTO quota for sugar for refining. No additional volume other than a new quota of 10 Kt duty free at entry into force for Paraguay. Specialty sugars are excluded.

- Ethanol: 450 Kt of ethanol for chemical uses, duty-free. 200 Kt of ethanol for all uses (including fuel), with an in-quota rate 1/3 of MFN duty. Again, to be phased in in six equal annual stages. The 2024 updated negotiations also allow for an additional TRQ of 50 Kt of biodiesel to Paraguay on account of its land-locked and developing country status.

- Rice: 60 Kt duty free. This will again be phased in in six equal annual stages.

- Reciprocal tariff rate quotas: these will be opened by both sides and phased in over 10 years;

- Cheese: 30 Kt duty free. This will be phased in in ten equal annual stages stages. The in-quota duty will be reduced from the base rate to zero in ten equal annual cuts starting at entry into force.

- Milk powders: 10 Kt duty free. This will also be phased in in ten equal annual stages, with a similar reduction in in-quota duty as outlined for cheese.

- Infant formula: 5 Kt duty free. The will again be phased in via ten equal annual stages with similar reductions in in-quota duties as described above.

- Environmental safeguards: adherence to the Paris Agreement is included as an ‘essential element’ of the FTA. The agreement could be suspended if a party leaves the Paris accord or stops being a party in ‘good faith’ (i.e. undermines it from within). There are also additional provision around promoting sustainable supply-chains, helping to conserve biodiversity / livelihoods of indigenous peoples, especially in the Amazon.

There are concerns amongst several EU Member States, notably France, Ireland and Poland, about cheap imports from Mercosur undercutting EU products, compounded by less stringent production standards. A 2021 study by the Irish Government estimated that the EU-Mercosur deal could reduce the value of Ireland’s beef output by €44 – €55 million, equating to around 2-3% of output.

Whilst South American beef might not be permitted to come into the UK as a result of the EU-Mercosur FTA, there could be indirect impacts. For instance, displaced Irish beef will seek to find markets elsewhere with the UK being the most obvious choice. This could exert some downward pressure on UK beef prices, particularly in the food services segment. That said, UK beef prices have been very firm of late due to lower supply and in any case, it may take several years’ yet before an EU-Mercosur FTA enters into force, even if it gets that far. The likes of France and Ireland are likely to push back strongly against the deal.

Of course, if the EU can negotiate an FTA with Mercosur, the UK will also have an interest in exploring FTA opportunities, but that does not appear to be a priority for Labour presently. If/when negotiations do start, Mercosur is likely to seek more significant concessions with the UK, especially bearing in mind the precedent set by the Australia and New Zealand FTAs. However, it could be after the next UK General Election before a concrete trade deal is reached with the likes of Mercosur.

UK Border Controls

On 30th April, the UK Government introduced its next phase of border controls under its ‘Border Target Operating Model’ (BTOM), which was published in August 2023. This phase builds upon the customs controls, declarations, pre-notifications and health certifications introduced in January for imports from the EU and focuses on implementing documentary and risk-based identity and physical checks at UK Border Control Posts (BCPs) for goods subject to sanitary and phytosanitary (SPS) checks from the EU, excluding Ireland.

The key changes are;

- ‘Medium’ risk products: from a biosecurity perspective will now undergo identity and physical checks, which test for pests and diseases that could impact the safety of our food and harm the UK’s natural environment. Checks involve visual inspections and temperature readings of goods.

- ‘High’ risk products: will now be checked at the border whereas previously these goods were checked at the destination. These checks will be aimed at identifying public health issues such as salmonella, and build on existing safeguarding measures which identify diseases like African Swine Fever, which is now prevalent in certain European countries and poses a significant risk for UK pig farms.

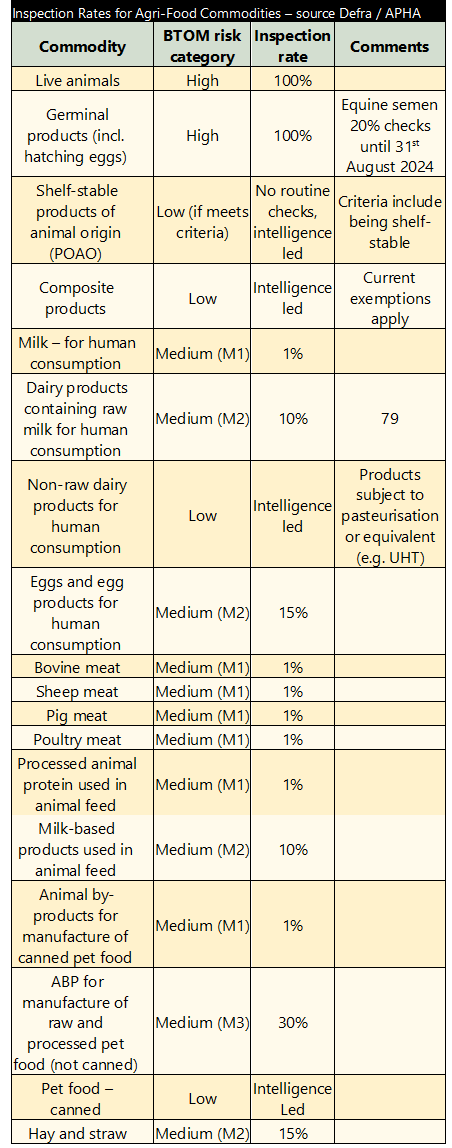

Separately, the UK Government has also published the BTOM risk categorisations and check rates for imports of live animals, products of animal origin (POAO) and animal by-products (ABPs) from the EU, Switzerland, Norway, Iceland, Liechtenstein, the Faroe Islands and Greenland to Great Britain. The inspection rate (percentage of times a product will be subject to identity and physical checks) depends on the risk category to which it is assigned, and is set out as follows:

- High risk commodities: will be inspected every time the product is imported (inspection rate 100%).

- Medium risk commodities: will be inspected at a rate between 1% and 30%.

- Low risk commodities: will not be subject to routine inspection, but they may be subject to non-routine or intelligence-led checks.

Further information on the inspection rates and associated requirements for the full range of products subject to SPS checks is available via; https://www.gov.uk/government/publications/risk-categories-for-animal-and-animal-product-imports-to-great-britain/target-operating-model-tom-risk-categories-for-animal-and-animal-product-imports-from-the-eu-to-great-britain

Importantly, checks on products entering Northern Ireland will be subject to the provisions of the Windsor Framework, which de-facto, permit Northern Ireland to continue to be part of the EU Single Market and Customs Union as regards agri-food goods. Accordingly, none of the additional checks or controls set out in the BTOM apply to imports into Northern Ireland from the EU.

For imports coming in from Ireland (i.e. Republic of Ireland), the Border Control Posts in Wales are under construction and are unlikely to be functional until the spring of 2025. Accordingly, the implementation of physical checks will be delayed until next year with a date to be confirmed.

In terms of the controls that have been introduced on April 30th, there have been some issues with key systems such as IPAFFS – the system used to manage the import of products subject to SPS controls. There have also been challenges with the extent of coordination between Defra and the HMRC on issues relating to the Automatic Licence Verification System (ALVS) – the system used to match customs and SPS documentation to a given vehicle. Whether these are just teething problems or will develop into longer-term issues remains to be seen.

Overall, it is crucial from a biosecurity perspective for the UK to have a fully-functioning border control system and that the gaps in the system following the UK’s departure from the EU are getting addressed. That said, such controls necessitate the imposition of friction at the border which means additional costs for businesses when importing from the EU. This will create some inflationary pressure and will likely lead to less choice for some agri-food products, particularly those supplied by small and medium-sized enterprises (SMEs).

Trade Update

After a relatively quiet few months on the trade policy front, recent weeks have seen a resurrection of previous debates around the future long-term relationship that the UK should have with the EU as well as the impact of new trade deals that the UK is in the process of concluding.

Talk of a Swiss-Style Relationship

Following the Chancellor’s Autumn Statement, rumours emerged from Government circles of a change in approach towards the long-term relationship that the UK would have with the EU. This would see it move towards something more akin to Swiss-style relationship. This would mean accepting free movement, contributions to the EU budget, dynamic alignment with EU regulations for goods, and European Court of Justice (ECJ) oversight in return for being part of the Single Market. Whilst some welcomed this, others claimed it was a betrayal of Brexit.

What many failed to acknowledge was that the EU is dissatisfied with how its relationship with Switzerland is structured as it requires more than 100 bilateral deals to replicate Single Market requirements and which constantly need to be renegotiated. It is unlikely to want to replicate this with the UK. In any event, the UK Government later denied that it was seeking to move to a Swiss-style relationship.

That said, and from an agri-food perspective, there is merit at looking at elements of the EU-Switzerland relationship and replicating aspects that make sense for both parties. In previous articles, we have advocated a Swiss-style Sanitary and Phytosanitary (SPS) agreement with the EU, whereby the EU would permit frictionless access for UK agri-food goods in return for the UK dynamically aligning with EU regulations. Whilst previous Tory administrations (i.e. under PMs Johnson and Truss) dismissed this approach, it would appear that the Sunak administration is at least considering it.

Such an SPS agreement would greatly assist UK exports to the EU, its biggest trading partner and it would also overcome key hurdles in the ongoing NI Protocol negotiations, which have shown some tentative signs of progress recently. Whilst it would mean the UK mirroring EU laws, it would still leave scope, albeit more limited, for the UK to negotiate separate trade deals and trading arrangements, as the Swiss have done with the US. The UK could also give notice (e.g. of one year) if it wanted to discontinue this arrangement.

Overall, the talk of using existing templates in framing the future UK-EU relationship is becoming unhelpful. The sooner a bespoke UK-style relationship emerges the better. This could incorporate key aspects of other templates, but it will need to respect key EU principles, meaning that further negotiation is needed. It will also need to incorporate the closer relationship that NI will have with the EU, as it is de-facto part of the Single Market for goods by virtue of the NI Protocol.

Eustice Attack on Recent Trade Deals

On 14th November, during a House of Commons debate on the Trade (Australia and New Zealand) Bill, the former Defra Secretary George Eustice severely criticised the UK Government’s negotiating strategy for both trade deals. He singled out the then Trade Secretary, Liz Truss, for particular criticism, especially for imposing an arbitrary target of concluding negotiations with Australia ahead of the 2021 G7 summit. He thought that this severely weakened the UK’s bargaining power. Mr Eustice recalled that there were ‘deep arguments and differences in cabinet’, which were mirrored by friction between Defra and the Department for International Trade (DIT) during the negotiations. He also claimed that the ‘Australia trade deal is not actually a very good deal for the UK’ and that he tried his best when Defra Secretary to address its shortcomings. Specifically, he claimed that there was no need to give Australia (and New Zealand) unlimited access over the longer term for sensitive sectors such as beef and lamb.

From a farming perspective, it is all well and good to criticise the deal. But during his time in Government, Mr Eustice defended it – his comments, therefore, offer scant consolation to farmers who perceive these deals to be a significant threat. Both the Australian and New Zealand agreements will increase the competitive pressure on UK agriculture, particularly in grazing livestock. However, recent studies looking at the impact of these trade deals projected that the impact may be lower than some fear. That said, being the first new trade deals that the UK has negotiated from scratch since leaving the EU, they create an important precedent, and the cumulative impact of multiple trade deals can have a more significant impact.

The UK-Australia trade deal was ratified by the Australian Parliament on 22nd November. The Trade (Australia and New Zealand) Bill is making its way through Westminster. It is currently at the Report Stage, where amendments can still be made to the Bill, before a final third reading and subsequent vote on the Bill in the House of Commons – the date of which has yet to be announced. The House of Lords will also have to vote on the final Bill and they could delay it for up to a year before it would receive Royal Assent (assuming it is passed by the House of Commons).

Trade Update – July 2022

Although summer is often quieter on the trade front, there have been a couple of developments in recent weeks which merit mention. These relate to the UK-Australia Free Trade Agreement (FTA), and the announcement of the EU trade deal with New Zealand (NZ), which will be of interest to many in the UK agri-food sector.

UK-Australia FTA

The UK Government has failed to offer MPs the opportunity to debate the UK-Australia FTA within 20th July deadline as required by the framework set-out under the Constitutional Reform and Governance Act 2010. This means that the FTA can be ratified by the Government without the parliamentary scrutiny that it had promised to the farming industry on several occasions. Many in the UK farming industry see this as a betrayal and are concerned that it will create a precedent for future trade deals that the UK negotiates.

Separately, the House of Commons Library published its assessment of the UK-Australia FTA on 15th July. It noted that whilst the overall impact of the FTA is limited (adding 0.08% to UK GDP (£2.3 billion per year) in 2035), it does note that the effects on agriculture will be more sizeable. It references the UK Government’s own assessment from earlier in the year which projects that long-term agricultural output would decline by £94 million whilst semi-processed food output would also decline by £225 million as a result of the deal. The impacts would be strongest in the beef and sheep sectors.

The report has also highlighted concerns around environmental, animal welfare and food safety standards. The report has noted the importance of distinguishing between two aspects of standards:

- Product standards which must meet before they can be imported into the UK

- Wider questions of differences in animal welfare and environmental practices permitted in Australia and the UK.

On the former, it highlighted the Government’s conclusion that the FTA did not require changes to the UK’s import rules or statutory protections concerning human, animal or plant life or health, animal welfare or the environment. Regarding the latter, it highlighted concerns around Australian products being produced to lower animal welfare and environmental standards than what UK producers (farmers) must adhere to. It also noted that the Government has refused calls for Australian access to the UK to be contingent on adhering to “core standards” as advocated by the National Food Strategy.

Whilst it is unsurprising that the Government has taken this approach, it will add to concerns in British farming that its competitive position will be undermined as future FTAs are negotiated and agreed.

The House of Commons Library report is available via: https://researchbriefings.files.parliament.uk/documents/CBP-9484/CBP-9484.pdf

EU-NZ FTA Announcement

On 30th June, it was announced that the EU and New Zealand concluded negotiations for a trade agreement. In announcing the deal, the EU Commission projected that bilateral trade could grow by up to 30% and also emphasised what it claims were unprecedented sustainability commitments to align with the Paris Climate Agreement. From an agri-food perspective, the Commission also highlighted that key EU sensitivities around agri-food products were also safeguarded. Key provisions of the announced trade deal include;

- EU agri-food exports to NZ: all tariffs would be removed from entry into force. This is unsurprising as most tariff lines for agri-food imports into NZ are already at 0% or at very low levels. Given the geographic distances involved, the benefits of this are likely to be limited to high-end niche food products, including chocolate, confectionary, ice-cream and wine.

- EU beef imports from NZ: the EU will permit a tariff rate quota (TRQ) of 10,000 tonnes (t) with a reduced duty of 7.5%. This will be phased in over 7 years and will have to adhere to EU standards. This level of access is substantially lower than what the UK has permitted (12,000 t in Year 1, rising to unlimited access from Year 16).

- EU sheepmeat imports: an additional TRQ of 38,000 t will be permitted to be imported duty-free, again phased in after 7 years upon entry into force. As the old WTO TRQ was split evenly between the EU27 and UK as a result of Brexit (i.e. 114,000 t each), it is more likely that this new TRQ will be activated, given the EU’s market size and population (circa 450 million). But again, the level of access is lower than that ceded by the UK to NZ (35,000 t in Year 1 rising to unlimited access from Year 16).

- EU dairy imports: the following provisions apply;

- Milk powder: a new 15,000 t TRQ with a 20% duty will be phased in over 7 years.

- Butter: NZ has currently access to the TRQ of 47,177 t allocated under the EU’s WTO schedule with the in-quota tariff of 38% of the MFN duty. Under the FTA, 21,000 t of this TRQ will have the tariff gradually reduced to 5%. The EU will also provide a new 15,000 t TRQ with the same gradually reduced tariff duty (i.e. from 38% to 5%).

- Cheese: the EU will allow 25,000 t to be imported duty-free via a new TRQ. This will again be phased in over 7 years. In addition, for 6,031 t of cheese TRQ that NZ currently has under the EU’s WTO schedule, the tariffs will gradually be reduced from €176/t to zero.

- High-protein whey: a new TRQ of 3,500 t with zero duty to be phased in over 7 years.

As with beef and sheepmeat, the concessions offered by the EU are generally less than what the UK has offered (more generous TRQs for butter and cheese with full liberalisation after 5 years).

More information on the EU-NZ FTA is available via: https://ec.europa.eu/commission/presscorner/detail/en/IP_22_4158

Overall, it is evident that despite agreeing this FTA, the EU will continue to offer a higher level of protection to its farmers than the UK has done with its FTA with New Zealand. That said, it must be emphasised that, like Australia, NZ continues to be heavily focused on the Asian markets, where it is getting strong prices for its produce. Just because increased access is available to the UK or EU markets, this does not necessarily mean that this access will be availed of.

Northern Ireland Protocol Bill

On 13th June, the UK Government introduced the Northern Ireland (NI) Protocol Bill to the House of Commons. The highly controversial Bill, if enacted, would dis-apply large swathes of the NI Protocol which was agreed between the UK and the EU as part of the Withdrawal Agreement negotiations. The Bill’s legal text which is highly complex and potentially far-reaching drew harsh criticism from multiple sources. It has been met with particular disdain by the EU which sees the Bill as a breach of international law and the Commission is set to respond in the near future. At a top-level, the Bill seeks to do three things;

- Disapplies large parts of the Protocol: relating to most provisions that apply EU rules on the movement of goods into NI.

- UK’s Protocol alternative: is outlined and the UK Government provides some guidance on how it would be implemented.

- European Court of Justice oversight: the Bill would remove the Court’s direct jurisdiction and the role for EU institutions

In essence, the Bill is effectively rewriting the Protocol, in a unilateral manner, outside of the structures agreed by the UK Government and the EU. Whilst the political fall-out will continue to generate intense debate, it is the accompanying policy paper which provides practical insights on how the Bill would work and the implications for agri-food. The key points are;

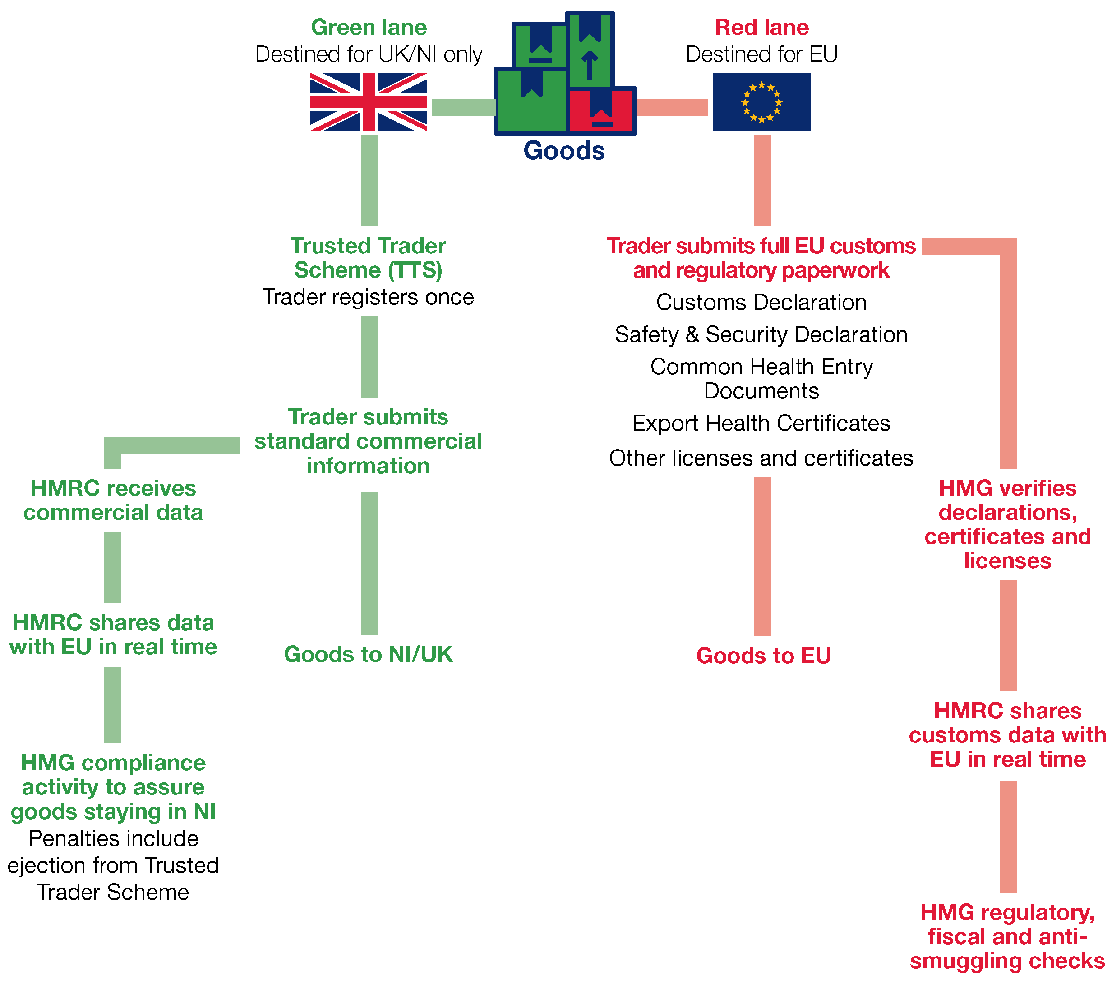

- Establish new ‘green channel’ arrangements for goods staying in the UK: it is claimed that this would fix the burdens and bureaucracy caused by the application of EU Customs and SPS rules. This channel would only be available to firms registered as ‘trusted traders’ and this scheme would be overseen by UK Authorities. Goods moving on to the EU or moved by firms not in the trusted traders’ scheme would use the ‘red lane’ and be subject to the full range of regulatory checks. This would significantly reduce the sometimes complex certification requirements for agri-food produce. Here, the UK proposals are not that far from the EU proposals published last October which suggested an ‘Express Lane’ for goods moved by trusted traders which would be consumed in Northern Ireland.

- Establish a new ‘dual regulatory’ model: this is intended to provide flexibility for NI firms to choose between UK or EU rules on product standards. It is intended to remove barriers to trade within the UK internal market and the UK Government claims that it will encompass robust commitments to protect the EU Single Market. For agri-food, goods could only move from GB to NI under the trusted trader scheme (otherwise they would be in the red lane and subject to checks). There would be robust penalties for violations. The EU strongly objects to this proposal on the grounds that it undermines the integrity of its Single Market. There are also challenges around the bureaucratic complexities involved with dealing with two regulatory systems. Major NI agri-food businesses are also against these proposals as it would scare-off overseas customers from purchasing NI produce as they would be unsure on which standards the products are adhering to and would be deemed too complex and risky.

- State Aid and VAT: the UK Government states that the Protocol restricts the UK from providing the same tax and spend policies in NI as the rest of the UK—with little room for flexibility. This aspect of the Protocol was insisted upon by the EU so that there was a level playing field between NI and the EU Single Market and that NI firms, or GB firms with operations in NI, did not gain an unfair advantage. The new Bill gives the UK freedom to disapply these rules so that NI can have the same tax rules as other parts of the UK. Again, the EU strongly objects to these proposals.

- Role of European Court of Justice (CJEU): would be removed in dispute settlement and would provide the means for UK Authorities and Courts to set out the arrangements which apply in Northern Ireland. This is also highly controversial from an EU perspective as it would not have agreed the Trade and Cooperation Agreement (TCA) with the UK if the CJEU did not have ultimate oversight over the NI Protocol.

Whilst the full EU response is awaited, it has confirmed on 15th June it is restarting the legal proceedings it had initiated last year against the UK Government for its unilateral extension of grace periods for checks on products such as sausages and mince. These had been suspended for almost a year to facilitate negotiations on addressing the Protocol issues. The EU response is also likely to state that it reserves the right to enact much more stringent measures if this NI Protocol Bill becomes law in the UK. This would include suspending key aspects of the TCA or introducing some tariffs on UK exports to the EU. That said, the EU will also be keen to get the UK back to the negotiating table and the Commission has set-out further proposals on how it thinks the outstanding issues on the NI Protocol should be dealt with.

From an agri-food perspective, it is important to note that the House of Lords will vote against this Bill, thus delaying its enactment for at least a year. This gives time for further negotiations to take place. However, additional negotiating time has been wasted in the past. Breaching International Law (which legal experts almost entirely agree would happen if this Bill were to be enacted)) is not the way to build trust. What is needed now is quiet and determined diplomacy to reach a deal that all parties can live with.

NI agri-food businesses are adamant that the Protocol delivers major benefits in enabling NI to access the EU Single Market whilst having unfettered access to GB. As we have mentioned previously, a UK-EU veterinary agreement would help greatly to reduce the burden of checks, not just GB to NI but also GB to the EU. On this, the EU needs to be more flexible. The UK will not opt for a Swiss-style veterinary agreement as that would mean following EU rules for the whole of the UK. A bespoke veterinary agreement should be a key part of the framework to resolve the remaining Protocol issues.

Trade Update

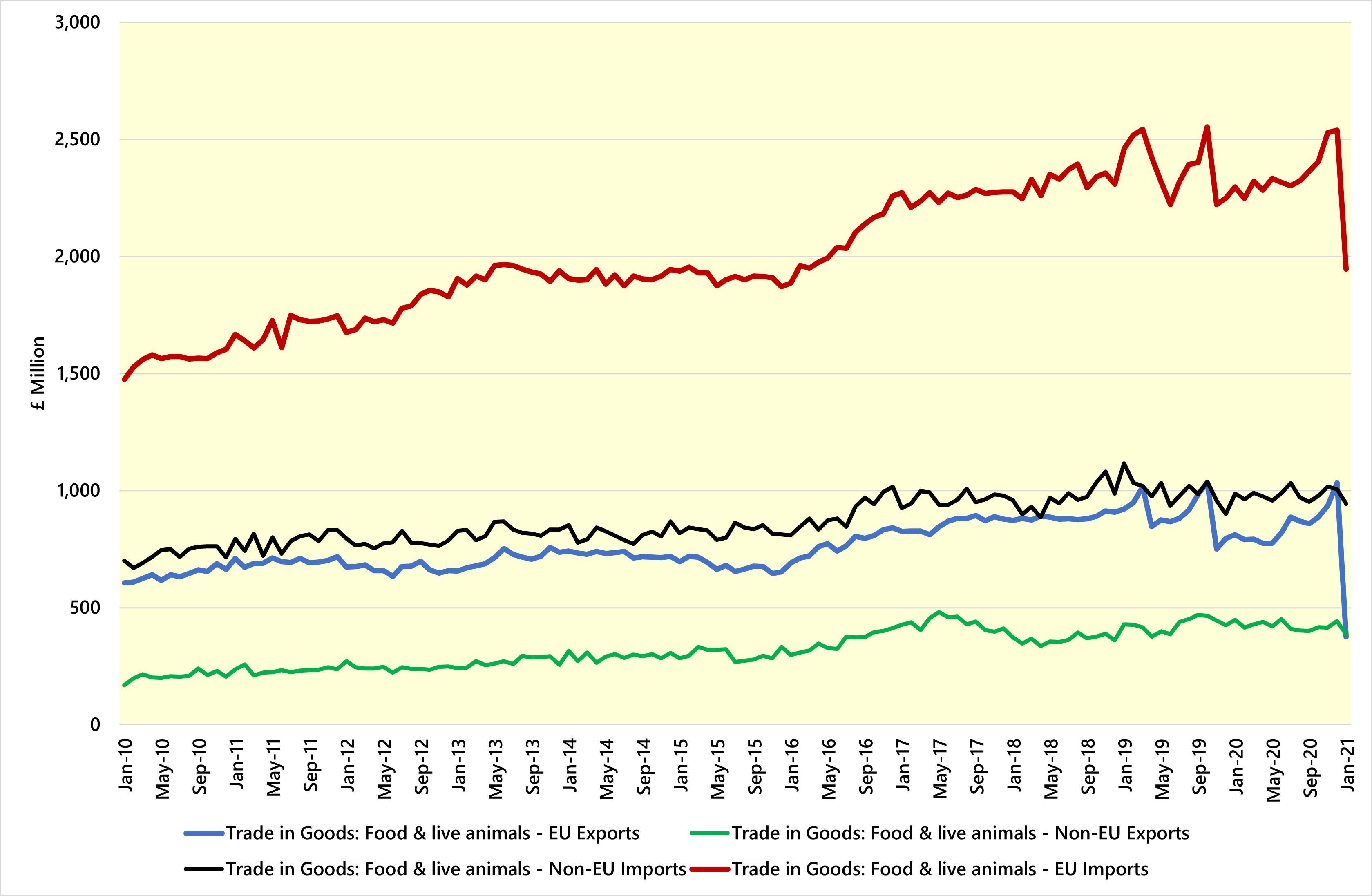

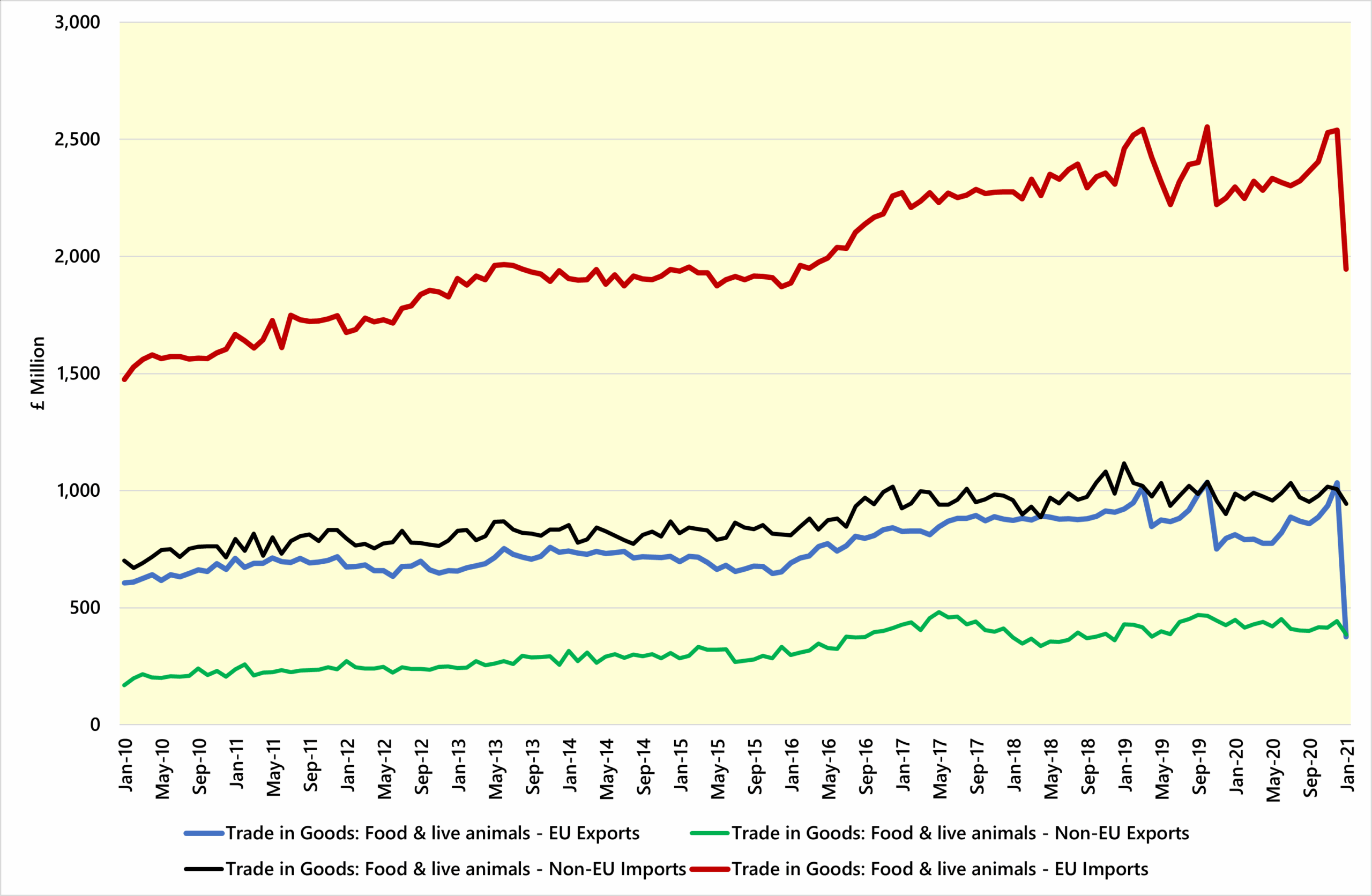

The Office for National Statistics (ONS) recently published UK trade data for January 2021. Unsurprisingly this has revealed significant drops in food and live animals trade with the EU. Whilst the 64% drop in exports to the EU captures the headlines, imports from the EU have also dropped by 24%. However, there are multiple factors at play and it is still too early to tell with accuracy how much trade with the EU will change as a result of Brexit.

As the chart below also reveals, there was a significant increase in trade with the EU from September 2020 as businesses stockpiled in advance of potentially significant border friction arising from a No Deal Brexit or a bare-bones trade deal. As it happened, the Trade and Cooperation Agreement (TCA) was comprehensive in the sense that there were no tariffs or quotas on agri-food trade; however, it did not include a veterinary agreement and left exporters to the EU with just one week to prepare for border controls. With the UK phasing-in controls on imports from the EU as a result of its Border Operating Model, the implementation of which has now been delayed until the year-end / early 2022, it was evident that UK exports to the EU would suffer more in percentage terms than imports. The January data has borne this out.

UK Food and Live Animals Trade with EU and Non-EU Countries – January 2010 to January 2021 (£ Million)

Source: ONS

Looking at the HMRC trade data (the source of the ONS figures) in further detail shows that exports of chilled beef to the EU have declined by 59% in January 2021 versus January 2020. Sheep and goat meat exports to the EU are down by 29%, pig meat exports to the EU are 78% lower, whilst butter and cheese exports are down by 67% and 61% respectively versus a year earlier.

Whilst the data are of concern, more time is needed before definitive conclusions can be drawn. Although there is still significant friction on trade and many of the TCA’s so-called ‘teething problems’ are in fact permanent fixtures, the situation has improved since January and traders who are well-organised are getting through the EU border controls. That said, given the complexity of UK-EU supply-chains, high value food products with multiple ingredients are experiencing significant issues, many UK traders are now looking at setting up distribution hubs and some processing facilities in the EU. This will permit them to send loads to a single destination, thus cutting down the paperwork significantly. From there, if further processing is needed, it will take place in the EU before moving to its end destination.

It will be mid-year before a definitive picture will emerge as agri-food trade is often lower during January to March. Trade should recover somewhat but probably not to the same levels as before. The significant decline in EU imports also presents opportunities for domestic suppliers to capture a greater proportion of the UK market, particularly in perishable agri-food products. This will mean that there will be winners as well as losers as a result of the TCA. That being said, supply-chains need time to adapt and such opportunities cannot be realised overnight.

Trade Agreements with Non-EU Countries

With the UK-EU Trade and Cooperation Agreement (TCA) in place, attention will increasingly shift towards Free Trade Agreements (FTAs) with non-EU countries. These can be divided into two broad categories;

- Rollover FTAs: these are agreements that the UK had access to when it was an EU Member State. In recent weeks, there has been significant progress. To date, the Department for International Trade (DIT) has already completed agreements with 63 countries, 60 of which became effective from 1st January. The other 3 (Canada, Mexico and Jordan) have been partially applied. This is an impressive feat considering the enormous challenges associated with Brexit and Covid-19. Discussions continue with 6 more countries including Serbia and Ghana.

As our previous article noted, although the negotiation with Japan was technically a ‘new’ FTA negotiation, the deal is essentially a rollover of the existing EU-Japan Partnership agreement. The UK-Japan agreement has some slight adjustments in terms of UK access to Tariff Rate Quotas (TRQs) and market access for products such as cheese.

- FTA Negotiations Underway: before the end of the Transition Period, DIT was already focusing on progressing FTA discussions with several countries. From an agricultural perspective, the most notable of these are the US, Australia and New Zealand. These negotiations will need to be watched closely as 2021 progresses.

Although the US trade deal negotiations get the most attention, progress may dissipate somewhat during 2021 as the Biden administration will have other priorities to deal with. However, talks will continue particularly as the UK-EU TCA has largely safeguarded the Good Friday Agreement – a key ‘red-line’ for the US.

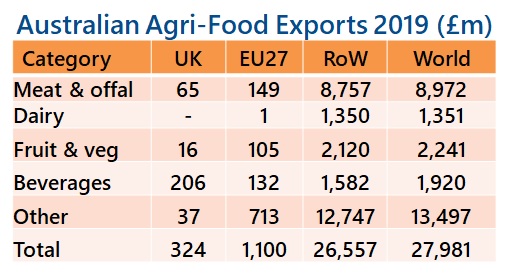

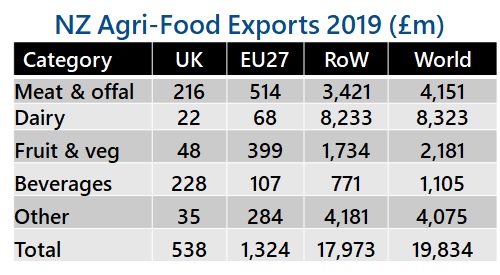

Perhaps the negotiations which are most likely to conclude in 2021 are those with Australia and New Zealand. As the tables below show, both countries are major exporters of meat (beef and lamb), dairy products and wine. A trade deal with these countries will exert the most pressure on UK grazing livestock. Admittedly, imports of beef and lamb from both countries into the UK and EU have been below historic levels recently. This is mainly a function of a greater emphasis being placed on the Asia-Pacific region. However, if the UK agrees a FTA with these countries it will lower trade barriers significantly versus current arrangements which operate via TRQs and standard WTO terms.

Sources: Sources: Australian DFAT / NZ Government / Andersons

Australia has been particularly eager to progress trade negotiations with the UK. Given the relatively high prices achievable in the UK, there is the potential for exports to be diverted from Asia-Pacific towards our market, particularly as China starts to recover from African Swine Fever and produces more of its own meat. From an agri-food perspective, export opportunities to both countries are limited to niche areas. Instead, the UK will use access to its food market as leverage to secure gains for its automotive and digital services sectors.

Longer-term, it inevitable that the UK will seek FTAs with other countries which will also exert significant competitive pressure on British farming. Chief amongst these would be an FTA with Mercosur, which includes Brazil and Argentina – – both beef exporting powerhouses. In recent years, Brazilian beef prices have been £1 per kg or more below the UK price. So, whilst the UK might be a net importer of beef presently and there is some scope for prices to increase given the frictions now placed on imports from the EU, future FTAs with non-EU countries have the potential to torpedo such gains, given the large price differences.

The agri-food industry needs to play close attention to the progress of new FTAs during 2021 and beyond, as they will have a huge influence over the future direction and competitiveness of British farming. The Trade and Agriculture Commission (TAC) set-up by the UK Government in July 2020 to examine the impact of new trade deals on UK agriculture will have a central role to play. However, it remains to be seen how much influence it will have in practice as Parliament will have the final say.

UK Trade Continuity Agreements

Good progress continues to be made on the UK finalising continuity agreements to replicate the trade deals that it was party to as an EU Member State. To date, such deals have been put in place covering 53 countries and, importantly, on 21st November, a rollover agreement was reached with Canada.

This agreement essentially replicates the provisions of the EU-Canada ‘CETA’ agreement, including specific tariff rate quotas (TRQs) for various agri-food commodities (e.g. imports of Canadian beef). However, detail is awaited on the apportionment of these TRQs between the EU27 and the UK as the legal text has not been published yet. One slight negative from the UK perspective is that it loses access to CETA’s cheese TRQ (14,750 tonnes for the EU (incl. UK)). However, it can continue to compete for the WTO TRQ (14,272 tonnes) that the EU has access to when exporting to Canada, for another three years.

It is also anticipated that this continuity agreement will form a prelude to a more bespoke UK-Canada deal which will begin to be negotiated in 2021. Although the deal only enables the UK to maintain the status quo with Canada, it is seen as a success for the UK, particularly as there were concerns earlier in the year that a rollover might not be concluded. Getting these rollover agreements has been a major effort for UK trade negotiators. Some agreements remain outstanding, most notably with Turkey, Egypt and Mexico, but discussions with these countries and 11 others are ongoing.

Brexit Day Arrives

After 47 years and a month of being a Member State, the UK will formally exit the European Union at 11pm (midnight CET) on the 31st of January. Whichever your viewpoint, the date will be historic. Whether it actually signifies the delivery of the promise to ‘get Brexit done’ is another matter. There is much to be decided as the 2nd leg of the negotiations on the Future Relationship take centre stage.

For agriculture, what we do know is that until the end of the year at least, the UK will enter a Transition Period where its trading relationship with the EU will remain effectively the same. The relationship with non-EU countries will also be unchanged as the EU is requesting those nations it has trade agreements with (circa 160 countries) to treat the UK as if it is still in the bloc, even though it will have formally left. This will mean that the UK will still need to comply with the obligations placed on the EU by the international agreements (covering trade and non-trade issues) until the end of the Transition Period. However, whether the UK continues to get the benefits of those international agreements is ultimately up to the partner countries. In practice, it is difficult to envisage partner countries refusing the UK as they are likely to be keen on striking up more attractive bilateral trade deals with Britain in the longer-term. This also means that while the UK can progress trade negotiations with other countries (e.g. the US), these could not become effective until after the Transition Period ends.

Once the European Parliament formally ratifies the Withdrawal Agreement (29th January), the next step in the process will be for the European Commission to formally receive its negotiating mandate from the European Council (the remaining 27 Member States). With the next Council meeting taking place on 20th February, formal negotiations with the UK are unlikely to begin in earnest until March. As a decision on extending the Transition Period is due by 30th June, this leaves very little time to have the bulk of the trade negotiations completed, let alone other issues relating to data, aviation etc. Despite the UK Government’s insistence, it is possible that an extension could be agreed. It can be the EU that requests this, rather than the UK, thus enabling the Government to claim it has kept its promise. Technically, only one extension is possible under the terms of the Withdrawal Agreement. It is, therefore, likely that some form of ‘flex-tension’ will be agreed whereby specific parts of the Future Relationship become operational whilst others are still being negotiated.

For now, the food and farming sector will continue to trade with EU and non-EU partners on the same terms as present. What happens with regards to standards in the longer-term remains to be seen. The Government has made conflicting noises of late and it is clear that it is pushing hard for its right to diverge in future, whilst pointing out that it will not diverge for the sake of it. The prospect of a ‘No Trade Deal’ with the EU at the end of the year cannot be ruled out either. So, all we really know is that Brexit will formally take place on 31st January and that the Ireland/Northern Ireland Protocol (meaning no hard border on the island of Ireland) will apply, even in the event of a No Trade Deal. Aside from that, all of the uncertainty from last year will start to ratchet up as the clock (but not Big Ben) starts to tick once again.