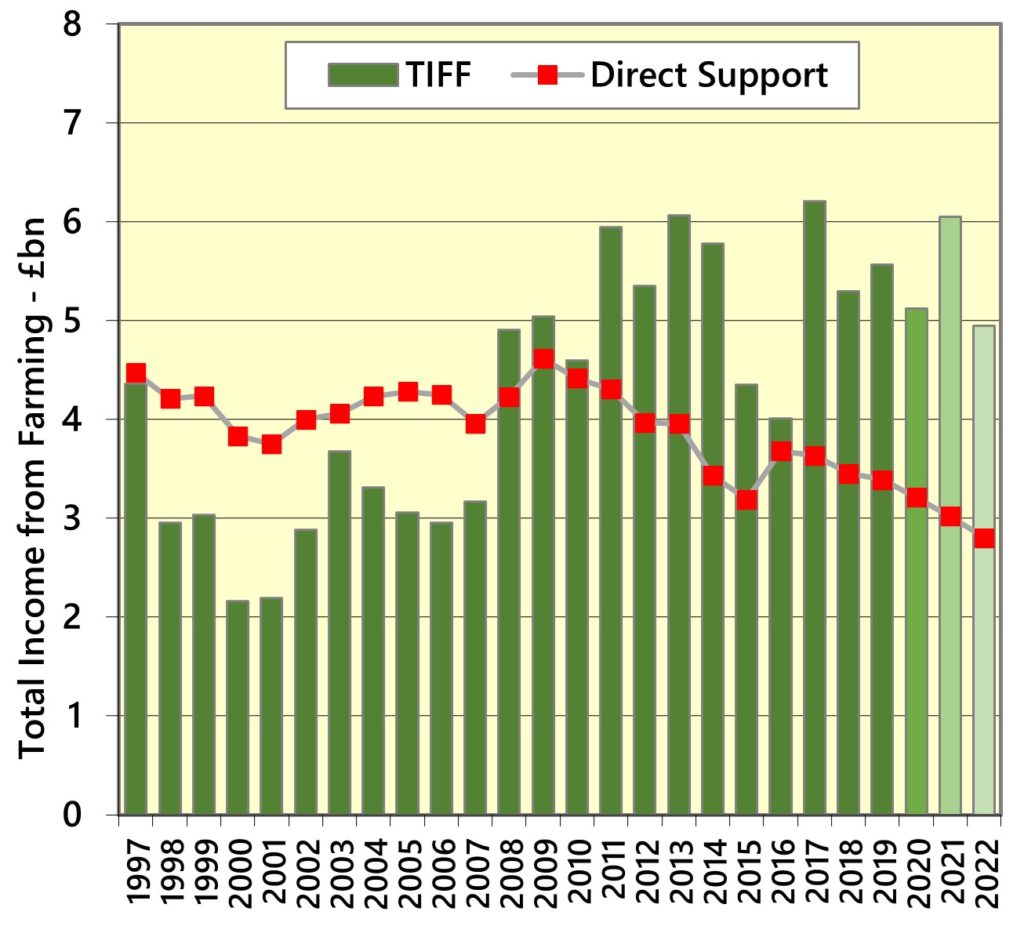

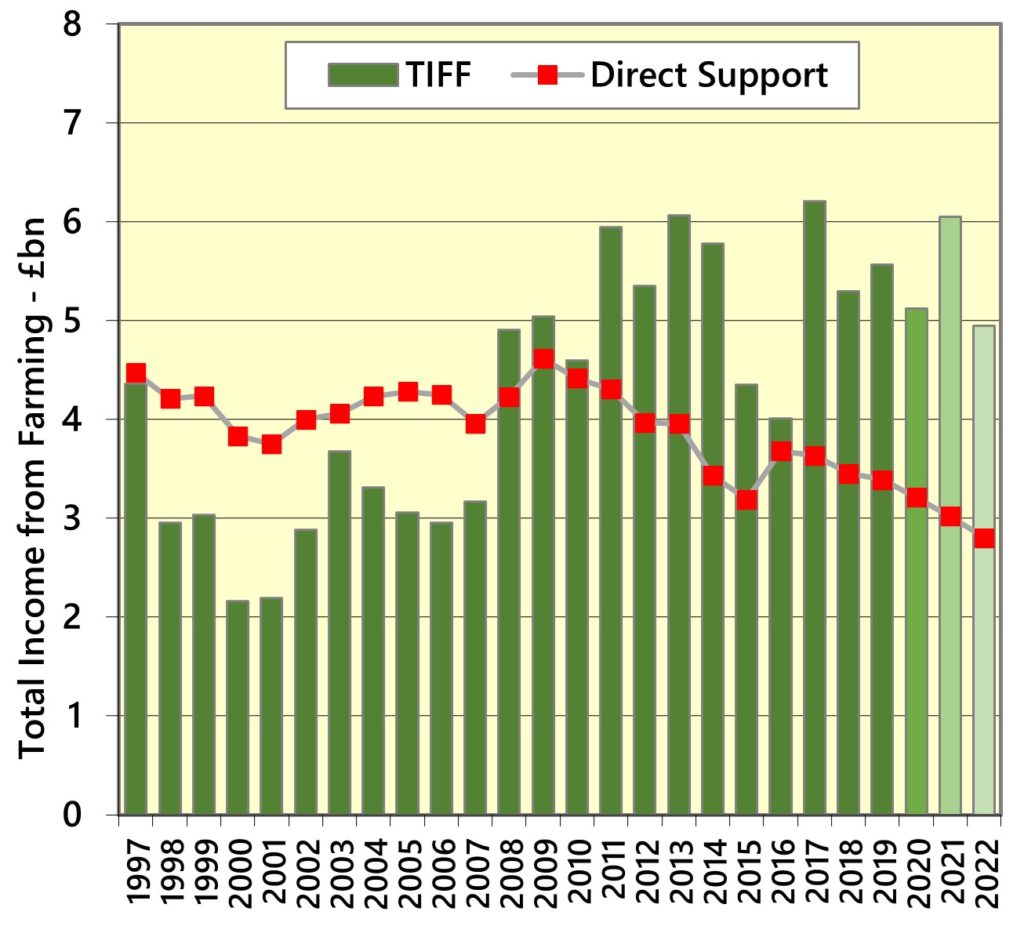

Big Uplift in 2020 Profits

The 2020 year was not as bad for farm profitability as first estimated. Defra has released revised figures for Total Income from Farming (TIFF) for the year. These show that total aggregate profits for the farming sector in 2020 were £5.121bn (real terms, 2020 prices). This is just an 8% drop compared to the 2019 returns. TIFF is the aggregate profit from all UK farming businesses for the calendar year. It shows the return to all entrepreneurs for their management, labour and capital invested.

When Defra made its ‘first estimate’ of 2020 profitability back in May, it had a year-on-year drop of 20% compared to 2019 (see https://abcbooks.co.uk/farm-profits-3/). The large revision is largely put down to two factors. Firstly, farm diversification was not as badly affected by Covid in 2020 as first estimated. Secondly, the volume of seeds, fertilisers and sprays used in the year was lower than first thought. This will be linked to the lower planted areas for harvest 2020 and more spring cropping.

Whilst this revision is quite large, it is not a huge surprise. The figures coming out of the Farm Business Survey (see last month’s article) had already suggested that the 2020 year was not as bad financially as many had feared. This is also borne out in individual farm accounts.

We had been forecasting that 2021 TIFF would be higher than 2020. This is still the case, although the uplift in last year’s figures means the ‘rebound’ will be less pronounced. Even so, it seems quite possible that aggregate UK farm profits for this year could be back at the £6bn level which has tended to be at the upper end of the range in recent years. With the large cost increases seen in recent months, it seems likely that 2022 will drop back again.

At this time of year Defra usually provide their initial forecast of TIFF for the year. However, the first official figures for 2021 profitability will not be published until January or February. For more information on the farm income figures see – https://www.gov.uk/government/statistics/total-income-from-farming-in-the-uk

Farm Productivity

At the same time as the TIFF data was released, updated figures on UK agricultural productivity were produced. The series is Total Factor Productivity (TFP), this measures how well farming converts physical inputs into outputs and gives an indication of the efficiency and competitiveness. TFP dropped 4.5% between 2019 and 2020. This is largely attributed to the effects of the weather in autumn 2019 through to spring 2020. Like the TIFF the figures have actually improved since the initial estimates (the drop had been 6.7% previously).

For more details see – https://www.gov.uk/government/statistics/total-factor-productivity-of-the-agricultural-industry