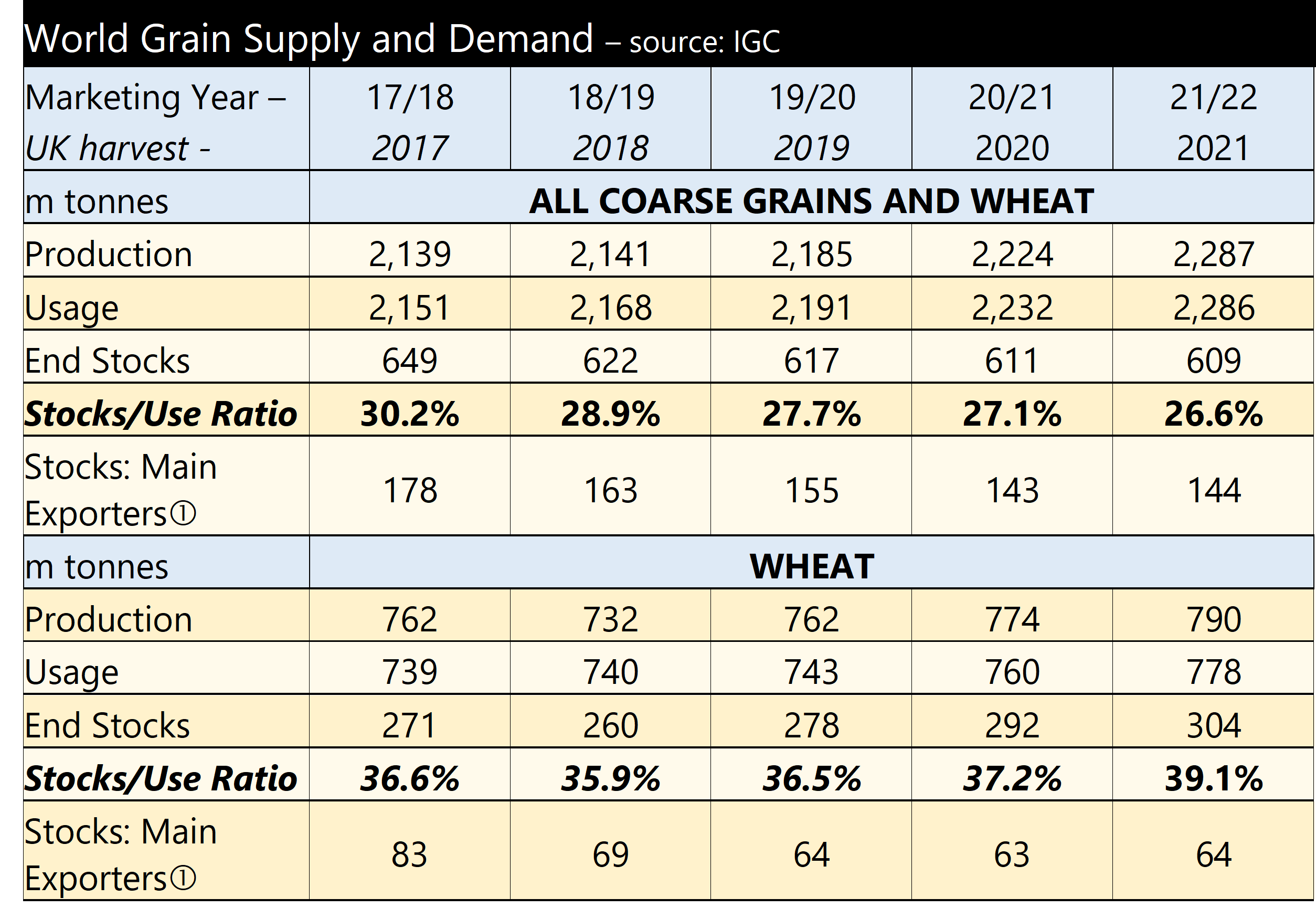

The International Grains Council (IGC) has released its first full supply and demand projection for the 2021/22 year. This shows 63 million tonnes more grain production than last year at 2,287 million tonnes (a 2.8% increase). Production rises each year because demand does too and the rise in demand of ‘only’ 54 million tonnes simply halts the decline in stock levels. The level of grain stocks entering the new marketing year is the lowest for four years – this is what is fuelling the global price rises.

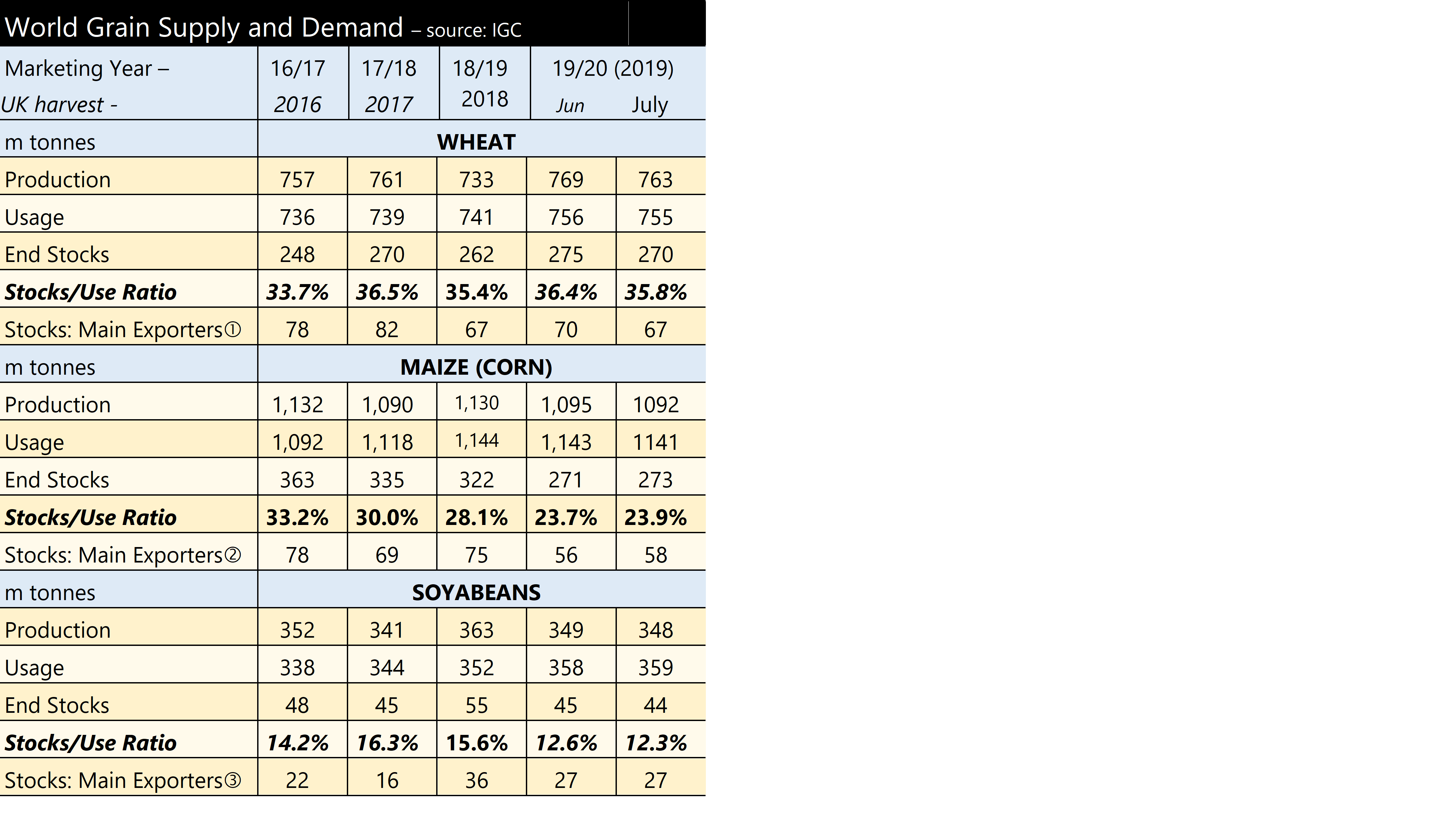

The table below demonstrates the figures .

19/20 figures estimates; 20/21 forecasts; 21/22 projections Argentina, Australia, Canada, EU, Kazakhstan, Russia, Ukraine, US

A small rise in wheat partially offsets the decline in total grains. This matters in the UK because wheat is the dominant cereal crop. However, this means the coarse grain decline is greater still. The figures are marginal at this stage of the year, but it means that the current concerns of continued excessively dry weather, or the arrival of persistent rain in the key grain growing parts of the world could have major swings in the availability of grains for the coming year, and prices accordingly.