On 7th August, the UK Government announced plans for a Trader Support Service (TSS) to be established for Northern Irish businesses. This will help them complete customs-related processes, required for importing goods into Northern Ireland as a result of the NI Protocol, and cost £200 million. There will also be additional funding (£155 million) to develop new technology to ensure the new processes can become fully digital and streamlined.

The announcement has been welcomed by NI business groups as it will help to address a key aspect of operationalising the NI Protocol. However, significant hurdles remain. Most notably, Sanitary and Phytosanitary (SPS) processes are not included, although the Government is working with NI businesses to address these. Furthermore, the tender for this work was also published on 7th August, leaving less than 150 days (before the Transition Period ends) to develop, test and roll-out the new system which has not been tried anywhere else before.

They focus of the Government’s announcement was on trade moving from GB to NI. In this regard, the TSS will help NI businesses (traders), at no additional cost, by;

- Recording electronic information on goods movements so that traders do not have to engage with new digital customs systems or processes.

- Complete formalities (e.g. import declarations, safety and security information) on behalf of NI traders. Therefore, businesses using TSS do not need to access HMRC customs systems (e.g. CDC, ICS) themselves.

- NI traders, once registered, will receive guidance on what the Protocol means for them and will also receive assistance on understanding what information will need to be collected about their goods including their description, value and any supporting information needed.

For trade moving from NI to GB, the UK Government has claimed that due to unfettered access, there will be no special customs processes applied, apart from some exceptional cases (e.g. making use of duty suspensive procedures such as transit procedures). For such businesses, support will also be made available via the TSS with more details in due course.

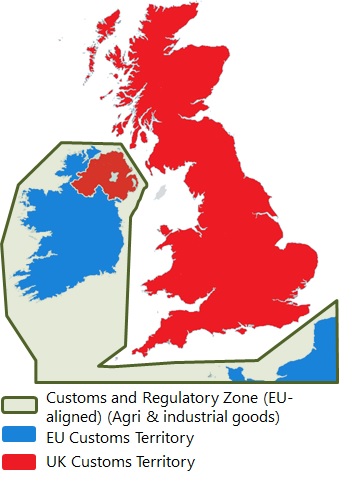

The UK Government is also intent on ensuring that there will be no tariffs on internal UK trade, even under No Deal, and full use of waivers and reimbursements would be made available in such a scenario. However, arrangements will need to be made for goods ‘at risk’ of moving into the EU Single Market (including the Republic of Ireland) but this firstly requires a decision by the UK-EU Joint Committee on which products are deemed to be ‘at risk’. These could potentially require a tariff (under a No Deal / limited Free Trade Agreement (FTA) scenario). Further details on this issue will be announced in due course. Further information can be found via: https://www.gov.uk/government/publications/moving-goods-under-the-northern-ireland-protocol

The announcement is seen as a big win for NI business groups who have been lobbying the UK Government hard on this over the past four years. Their next focus is on getting similar support to help businesses to address the significant SPS regulatory hurdles which also need to be overcome in the agri-food sector. The UK Government is expected to make further announcements on this in the coming weeks. However, making the announcement and allocating the funding is only the start. Operationalising all of this so that it is ready to function smoothly from 1st January remains a monumental task, particularly given the UK Government’s patchy record on IT systems. GB-based businesses that trade with the EU continent are likely to be envious of this arrangement. That said, the UK Government has previously announced that customs’ aspects of its Border Operating Model would be phased in over six months from January 2021, whereas arrangements under the NI Protocol need to be in place by January.