The Bank of England increased UK base rates on Thursday 3rd February from 0.25% to 0.50%. This is in response to rising inflation. Further increases are expected.

The Bank of England increased UK base rates on Thursday 3rd February from 0.25% to 0.50%. This is in response to rising inflation. Further increases are expected.

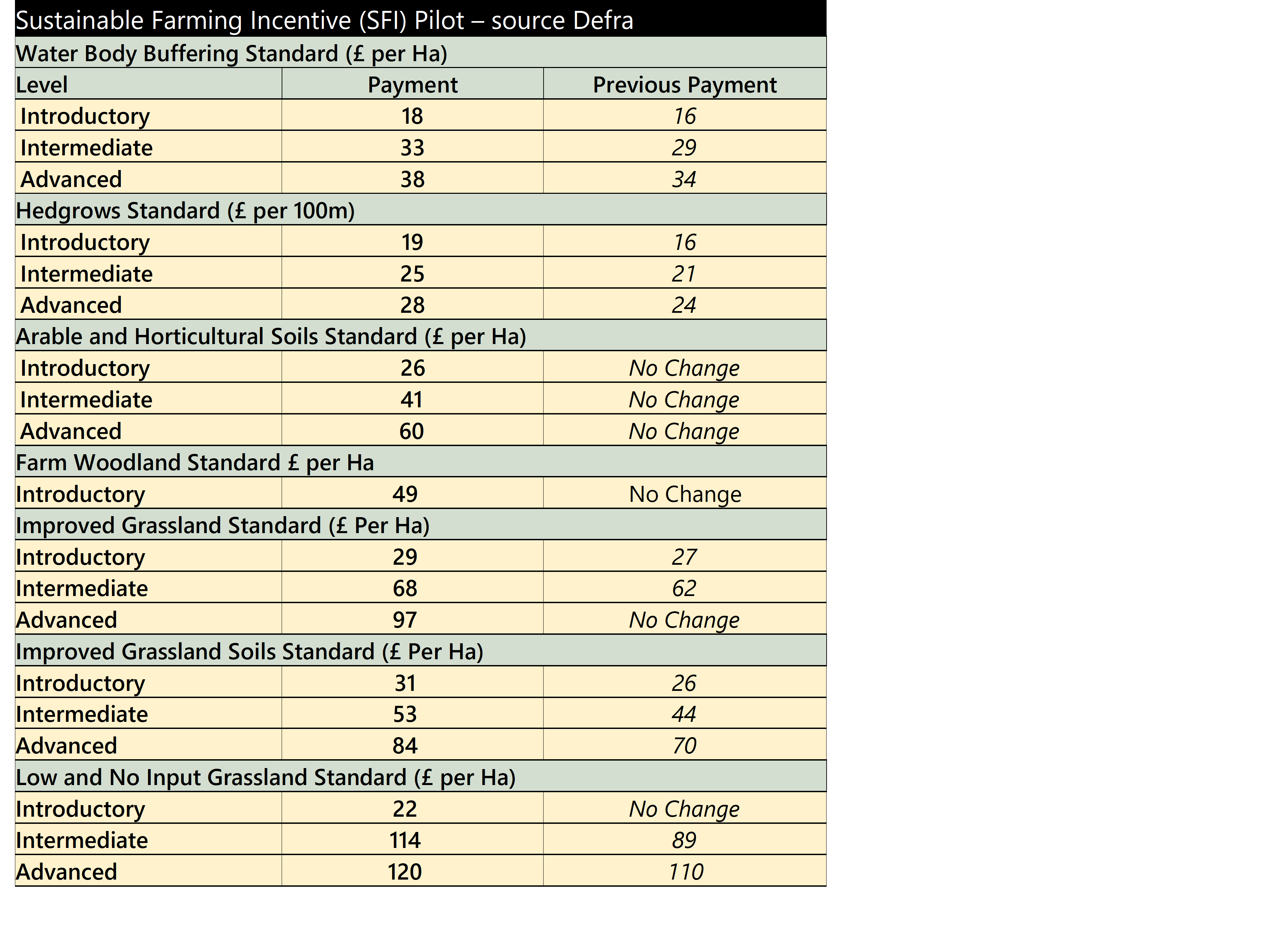

The payment rates for the SFI Pilot have been revised. Some of the payments have remained the same whilst others have seen an increase. The table below shows the updated rates alongside the previous payment for comparison. Some Pilot agreements will have already started, others are still being agreed but the new payments will apply from the start of all agreements.

Where agreements have commenced, an updated agreement can be obtained by signing in to Rural Payments service to ‘Generate’ and ‘Download’ and updated version.

The application window for the first round of Landscape Recovery pilot projects is now open and will close on 24th May 2022. Landscape Recovery is the third component of ELM. It is for farmers and land managers, including groups, who want to take a more radical and large-scale (500-5,000 Ha) approach to producing environment and climate goods on their land, such as establishing new nature reserves, restoring floodplains to help reduce the risks from flooding, or creating woodland and wetlands. The first round will focus on;

The application process is competitive. All ‘bids’ will be scored against assessment criteria. Defra and expert advisers will evaluate the applications and aim to get back to all applicants with a decision by 8th July 2022. The selected projects will initially be awarded project development funding. Up to 15 projects will be taken forward within the total project development budget available of £7.5m. Over the course of the project development phase, which will last up to two years, there will be the opportunity to negotiate public and private funding for implementation. If a project meets Defra’s requirements at the end of the development phase, it will be awarded long-term funding. Implementation agreements are expected to be long term, 20 years plus.

Application is via Defra’s eSourcing Portal, for further information and guidance on applying go to: https://www.gov.uk/guidance/apply-for-landscape-recovery-funding-to-protect-native-species-and-improve-rivers?utm_medium=email&utm_campaign=govuk-notifications-topic&utm_source=6b4aa2ed-04c7-4476-b410-2b245a7fc0f8&utm_content=daily

Grassland derogations for livestock manure in Nitrate Vulnerable Zones (NVZs) will be offered again in England in 2022. The derogation allows up to 250kg of nitrogen per hectare, if the nitrogen comes from grazing livestock manure. The limit is usually 170kg per Ha. The derogation is only available to those whose holding is at least 80% grass. The application window is pretty short and will run from 1st February to 28th February. A new derogation needs to be applied for each year by telephoning the Environment Agency on 03708 506 506 (Monday to Friday, 8am to 6pm) with details of the amount of manure nitrogen produced by grazing and non-grazing livestock on the holding in the calendar year. For more information visit the Defra website at https://www.gov.uk/guidance/grassland-derogations-for-livestock-manure-in-nitrate-vulnerable-zones .

It is now possible to transfer land and entitlements online in England in readiness for this year’s BPS applications. Claimants have until 16th May (the 15th is a Sunday) to complete the transactions. It is also possible to ‘add land by email’ now; useful where land cannot be transferred online. The email should include:

Emails need to be sent to [email protected]. The RPA will need to receive emails by 3rd May to ensure they are completed in time for claimants to make their applications by 16th May deadline.

In Wales, the transfer notification facility for 2022 entitlements is also available on RPW Online. Note though, RPW must be notified by 15 May 2022 in order for the recipient to make a claim on entitlements they are receiving for the 2022 BPS scheme year.

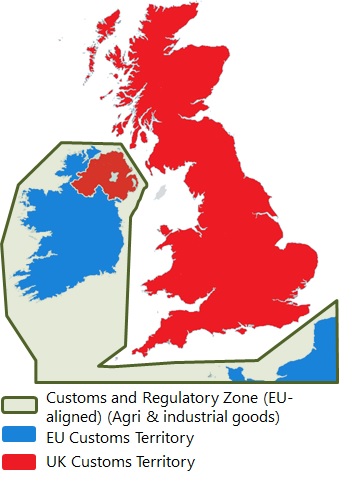

In comparison with previous years, the negotiations relating to Brexit went relatively quiet over the Christmas period. With the Foreign Secretary, Liz Truss, assuming the responsibilities of Chief Brexit negotiator, it is hoped that a breakthrough can be achieved on the remaining issues, particularly the Northern Ireland Protocol. There have been lengthy lorry queues on the approach to Dover this month – a reminder, if one was needed, that Brexit is not yet done and we’re into the era of ongoing Brexit.

In mid-January, Liz Truss met her EU counterpart Commission Vice-President Maroš Šefčovič at Chevening House (Kent) in what was described as a cordial atmosphere. Whilst the tone between both parties has improved, significant issues relating to the NI Protocol remain. Some of these such as the European Court of Justice (ECJ) oversight and the extent of the removal of regulatory checks on goods from GB destined for NI are well-known. The EU was surprised by the extent to which the Foreign Secretary pushed for the removal of the approval system for State Aid under the Protocol (i.e. Government subsidies to companies with operations in NI that trade with the EU). Whilst the EU are open to looking at ways of speeding up the notification and approval system for State Aid to NI-based companies, they are unlikely to agree to its removal.

Similarly, for regulatory checks, its (limited) proposals in October (see previous article) showed that the EU is willing to offer some flexibility on the extent of checks and it claimed that Sanitary and Phytosanitary (SPS) checks on meat and dairy could be reduced by half whilst customs checks could be reduced by 80%. However, the EU will not countenance their removal as they are seen as vital to protecting the Single Market.

Both parties have agreed to intensify talks from late January with the ambition of concluding talks by the end of February to resolve the remaining issues. With the NI Assembly elections taking place in May, both sides would be keen to have the lingering issues resolved by then. Much will depend on the extent to which Liz Truss will be prepared to compromise to do a deal. Ultimately, both sides will need to show some more flexibility if there is to be an agreement.

On 21st January, there were 17-mile tailbacks on approach to Dover. In normal circumstances, there is usually a rebuilding of trade volumes following the Christmas period and it would appear that this coupled with the impact of absences due to Covid and Brexit-related checks (which have been imposed on UK to EU trade since January 2021) have caused the delays. The situation has improved somewhat since, although there is concern that with the introduction of biometric checks for entry into the EU from September will lead to more substantial delays. Of course, significant delays at borders between countries is not uncommon. Similar issues arise at the US-Canada border, despite there being a free-trade agreement between both countries.

That said, the UK-EU situation could be improved significantly if the Trade and Cooperation Agreement (TCA) was enhanced further. From an agricultural perspective, a veterinary agreement between both parties would be helpful, even if it is more akin to a NZ-style agreement which only cuts the volume of checks at the border, but does not remove the need for health certificates. It is also evident that some form of agreement on mobility provisions is required to make work activities in the EU less onerous and to pre-empt issues caused by the introduction of biometric checks. Improvements to the rules of origin provisions of the TCA to help to make it easier for goods with inputs from multiple sources to qualify for tariff-free trade would also help.

Overall, recurring queues at Dover will be an ongoing feature of UK-EU trade. These can be mitigated to a large extent by a more pragmatic approach from both the UK and EU authorities but it may take some time before the political will is there to make such accommodations.

The Government wishes to increase access to nature and ensure protected landscapes can deliver more for ‘climate, nature and people. This comes in its response to the Landscapes Review undertaken by Julian Glover, which looked at whether the protections for National Parks (NPs) and Areas of Outstanding Natural Beauty (AONBs) are still fit for purpose (see https://abcbooks.co.uk/national-park-review/).

The response stops short of the recommendation in the Review to set up a new body, but does include the proposal to establish a ‘Landscapes Partnership’ to build on the existing collaboration between National Parks England and the National Association for AONBs. This would be complemented by roles for the National Trails and National Parks Partnerships with the aim of sharing knowledge and tackling common objectives such as nature recovery and improved public access. There is also a proposal to create a single set of statutory purposes for ANOB teams and National Park Authorities, providing more consistency and a unified statutory framework for all protected landscapes. It is acknowledged that the current statutory purpose to ‘conserve and enhance’ is not strong enough. This will be strengthened to ‘actively recover nature in these areas’. The response also includes proposals to;

Some of the Government’s proposals will involve changes to primary legislation and a 12-week consultation is now underway for these measures, closing on 9th April. The consultation can be found at https://www.gov.uk/government/consultations/landscapes-review-national-parks-and-aonbs-implementing-the-review . The Government’s full response to the Landscapes Review is available via https://www.gov.uk/government/publications/landscapes-review-national-parks-and-aonbs-government-response. There may be concern in AONBs, which are being ‘upgraded’ to near-National Park status, that some of the problems of being in a National Park may follow. These are chiefly around the focus on ‘conservation’ in its widest sense – with development or change for almost any reason, being very difficult to achieve.

The second round of the Future Farming Resilience Fund will be available until September 2022. The fund, which offers farmers free business advice to help them prepare for the agricultural transition in England, was due to close in March 2022. But according to Defra, the take up has been slower than expected due to the late harvest. The 19 providers have been given a six month extension, although not all have taken up all of this time and they can only take on a limited number of businesses so those interested should apply sooner rather than later.

The advisors offer support in different ways. Some are delivered via workshops or webinars, others offer free one-to-one business reviews and plans. Refer to Defra’s website to see the providers and the new end dates https://defrafarming.blog.gov.uk/2022/01/14/more-time-for-farmers-to-apply-for-free-business-advice/

The final phase of support under the Future Farming Resilience Fund will be available over a longer timescale. It should be launched later in 2022 and will run until 2025.

The Agri-Environment Climate Scheme (AECS) will open in Scotland on Monday 24th January 2022. For most applications the closing date will be 29th April 2022, although there are few exceptions;

For 2022, most applications will require a full Farm Environment Assessment, covering the whole holding. Most will also require one or more management plans and new mandatory templates are being provided for 2022; Wader options will require a wader management plan. For those applying for management of an SSSI or deer management it is advised to contact NatureScot before preparing an application. Further information is available on the Scottish Government website at https://www.ruralpayments.org/topics/all-schemes/agri-environment-climate-scheme/

The Improving Farm Productivity grant is now open for applications. It is the second theme under the Farming Transformation Fund (the first one was Water Management). The grant will pay for capital items to improve farm and horticulture productivity and will pay up to 40% of the costs for;

The minimum grant is £35,000 and the maximum per theme is £500,000. There is a two-stage application process; between 19th January and 16th March 2022 applicants are required to complete an online checker with business information and outline project details. The checker will give the applicant a score, showing how well the project fits with the three funding priorities – improving productivity, improving the environment and introducing innovation. It is possible to go through the checker multiple times to improve the application, before submitting it. The funding is competitive, the RPA will inform those who are invited to make a full application. The closing date for full applications is 14th September 2022.

Further information can be found via https://www.gov.uk/guidance/farming-transformation-fund-improving-farm-productivity-grant?utm_medium=email&utm_cam paign=govuk-notifications-topic&utm_source=454adb13-48d1-4002-87c5-2f9acf9e083e&utm_content=immediately

Defra is also holding a webinar on Tuesday 25th January for those interested see https://teams.microsoft.com/registration/UCQKdycCYkyQx044U38RAg,5yXTj8SJWE-tGJ3Jh8xTKQ,bMRbicryNkifID4EpSWchQ,7pa4VoVKR0-sbdny22ziNQ,cEBOVeI62ki2hBncOomt4Q,7xl8gYUc_0y-Lm1nbIA8OQ?mode=read&tenantId=770a2450-0227-4c62-90c7-4e38537f1102

The third theme under the Farming Transformation Fund will be Adding Value. This is aimed at adding value in food production and will be available in Spring 2022.