On 15th June, the EU Commission published two position papers fleshing out its October proposals (click here for more detail) on the additional flexibilities that it could offer on the operation of the NI Protocol. In a widely expected move, the Commission simultaneously announced that it was unfreezing legal proceedings that it had initiated against the UK last year but halted in July 2021 to facilitate further negotiations on the Protocol.

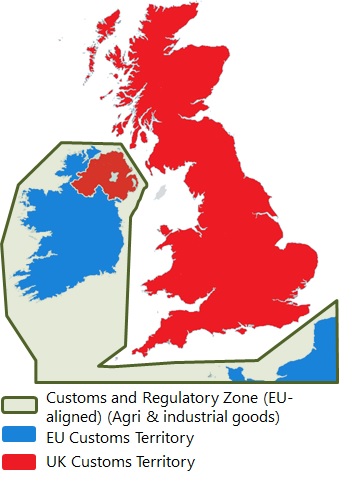

The Commission’s position papers are aimed at providing solutions to key aspects of the impasse surrounding the operation of the NI Protocol on the movement of goods from GB to NI. These papers focus on Customs and Sanitary and Phytosanitary (SPS) rules respectively.

Customs Flexibilities

The Commission’s proposals seek to dramatically reduce customs formalities and costs for goods deemed not at risk of being subsequently moved into the (European) Union. Here, the EU proposes to widen the scope of the previously proposed Trusted Traders Scheme (UK Traders Scheme) to encompass more companies, including SMEs. This means that such traders would be regarded as shipping goods ‘not at risk’ of entering the single market.

The Commission also proposes that such traders could avail of a ‘super-reduced data set’. They claim that this would reduce the number of data elements on a customs declaration falling from 80 to 21. This would also include simplifying commodity code requirements (i.e, entries would be based on 8-digits as opposed to 10-digits). The need for supplementary declarations would also be abolished for such traders.

In addition, the Commission is also open to looking at added flexibilities where there is evidence that traders have been adversely affected by the implementation of the Protocol as well as further flexibilities for NI firms processing GB inputs.

SPS Rules

The Commission paper proposes that a much reduced regime of controls would be available to ‘authorised retailers’ operating in NI and their GB-based suppliers. These would be available to traders regardless of size and would be expanded to include the hospitality sector, schools, canteens, and supermarket distribution centres, on the proviso that the food would be packed and labelled for end consumers in Northern Ireland.

One notable proposal is that of a ‘single simplified official certificate’ being required for each lorry load of mixed retail goods. This certificate would be signed by a UK Competent Authority and would replace the potentially numerous official certificates that would be required for such loads if the Protocol was fully implemented in its current form. The Commission also claims that documentary checks could be performed electronically and that identity and physical checks could be reduced by 80%.

The Commission has claimed that these flexibilities will require changes to EU laws, including its sensitive food safety regulations. This would be subject to some preconditions and safeguards implemented on the UK side.

UK Government Reaction

Given the publication of its NI Protocol Bill a couple of days beforehand which effectively supplants the existing NI Protocol, it was unsurprising that the Government’s initial reaction was negative. It claimed that the implementation of the EU’s proposals would mean a worsening of the current trading situation (note: grace periods are still in place for some agri-food products). Also, despite the EU’s proposed facilitations for products such as chilled mince or sausages, Veterinary Certificates would still be required. Instead, the UK wants EU Member States to give the Commission a mandate to renegotiate the entire Protocol – something that the EU side is adamant will not happen.

Overall, whilst the EU Commission’s positions papers represent some movement, its latest flexibilities are still predicated on the October 2021 proposals. It is apparent that they do not go far enough for the UK side. Also, NI business groups, whilst seeing these position papers as a basis for further discussions, would like to see more flexibility from the EU side. The EU Commission has emphasised that it stands ready to re-engage in negotiations with the UK Government to solve the remaining Protocol issues. What is clear is that the basis of a ‘landing zone’ is visible. There is common ground between the UK Government’s green lane proposals in the NI Protocol Bill and the EU’s express lane approach, initially put forward last October. But, much more work is needed for both sides to reach common ground across all issues.

The EU Commission’s position papers are accessible via the links below;

- Customs – https://ec.europa.eu/info/files/protocol-ireland-northern-ireland-position-paper-possible-solutions-customs_en

- SPS – https://ec.europa.eu/info/files/protocol-ireland-northern-ireland-position-paper-possible-solutions-sanitary-and-phytosanitary_en