Cattle

Prime cattle prices are on the increase again. After rising strongly from March, the GB all prime average deadweight price peaked at the beginning of May at over 65p per kg more than the five-year average and over 85p per kg higher than at the same point last year, when prices were (admittedly) at their lowest. Deadweight values eased a little throughout May but have been increasing again since June. The GB all prime average for the week ending 17th July was back over £4 per kg at 400.08p. For those hitting R4L specification, steers rose by 1.3p per kg on the week to 411.0p per kg and heifers by 2.4p per kg to 411.4p per kg for the same week. Liveweight cattle prices are also up for the week ending 21st July; the all steer price by 3.3p per kg and all heifer price by 2.5p per kg to average 228.2p per kg and 234p per kg respectively. The only cattle category to post a decline was cull cows. Tight supplies continue to support the beef price with estimated slaughter numbers for prime cattle down by 1,000 head to 30,700 compared to the previous week.

Lamb

There was a sharp (seasonal) decline in lamb values at the beginning of June as New Season Lamb (NSL) numbers increased, but prices have remained comfortably above the highest price for the last five years. Values stabilised by the end of June. Prices for the latest week have seen an uplift as demand increased for the Muslim festival of Eid al-Adha which ran from 20th – 23rd July. For the week ending 21st July the GB average NSL (liveweight) SQQ rose by 9.4p per kg on the week to average 260.7p per kg. This is more than 44p up compared with the same week in 2020 and 70p higher than the 5-year average. Deadweight values have also experienced an uptick. For the week ending 17th July the GB NSL SQQ rose by 2.1p per kg on the week to 548.5p per kg some 69p per kg more than for the same week last year and 106p per kg more than the 5-year average.

Pigs

GB finished pig prices continue to move upwards and are now comfortably above the 5-year average. For the week ending 17th July the EU-spec SPP rose 0.78p per kg on the week to average 160.66p per kg. Even so they have still not quite caught up to last year’s values. However, prices started to decline at this point in 2020, so if values continue their steady increase they look set to overtake last year shortly. Slaughter numbers were notably down on the week by 6,400 (3.7%) and 10,700 head compared with the same week in 2020, with reports of staffing shortages in processing plants probably due to workers being ‘pinged’ due to Covid-19.

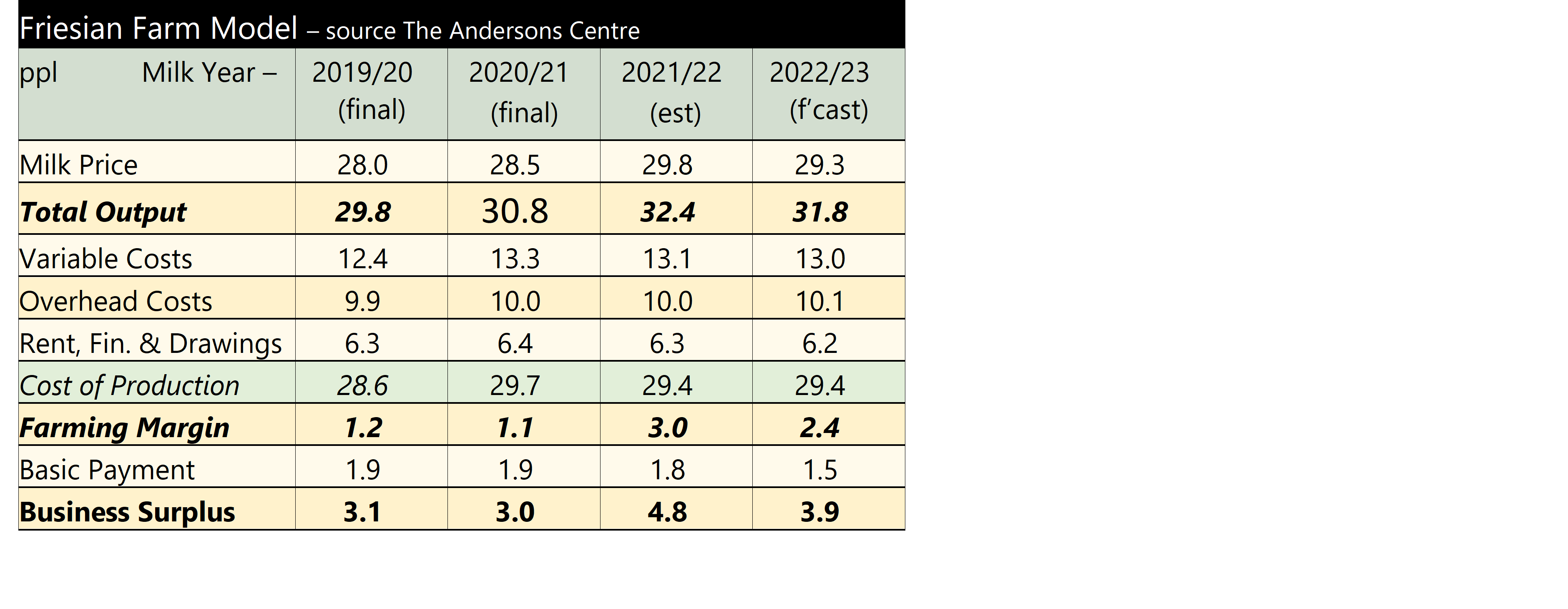

The 2019/20 year showed a recovery in profitability after the drought-hit 2018/19, even though the milk price was weaker. Farmgate prices firmed slightly for 2020/21, however variable costs rose – in particular feed, following the poor harvest of summer 2020.

The 2019/20 year showed a recovery in profitability after the drought-hit 2018/19, even though the milk price was weaker. Farmgate prices firmed slightly for 2020/21, however variable costs rose – in particular feed, following the poor harvest of summer 2020.